Don't Face the IRS Alone: Expert Audit Help You Can Trust

Why Facing an IRS Audit Alone Could Cost You Thousands

Audit assistance services are professional support offerings that help individuals and businesses prepare for, respond to, and steer tax audits, financial audits, and regulatory examinations. These services range from IRS representation and tax debt resolution to financial statement audit support and internal control reviews.

What audit assistance services typically include:

- Tax audit representation - Responding to IRS notices, state tax audits, and negotiating with tax authorities on your behalf

- Financial audit support - Preparing documentation, managing auditor requests, and ensuring compliance with accounting standards

- Pre-audit preparation - Reviewing records, identifying potential issues, and organizing documentation before auditors arrive

- Internal audit services - Evaluating company controls, processes, and compliance through independent assessment

- Specialized support - Industry-specific assistance for digital assets, pharmacy benefit manager audits, SOX compliance, and regulatory filings

If you've recently received a letter from the IRS, you might be wondering what it means and how to respond. You're not alone—and you don't have to face it alone.

The average PBM audit recoupment is $25,350, but members using audit assistance services achieve an 89% average reduction in those recoupments, saving an average of $22,561. That's enough saved from one audit to pay for professional assistance for the next 41 years.

The reality is simple: audits are complex, time-consuming, and potentially costly. Whether you're a gig economy worker who received your first 1099, a small business owner managing multiple revenue streams, or someone who simply made an honest mistake on their return, professional audit assistance can mean the difference between a minor adjustment and a major financial setback.

The good news? You have options, and expert help is available to guide you through every step of the process.

Understanding the "Why" and "Who" of Audit Support

No one likes the word "audit." It often conjures images of endless paperwork, stressful interrogations, and potentially hefty penalties. But let's be honest, audits are a part of doing business and fulfilling our civic duties as taxpayers. Understanding why they happen and who typically needs help can explain the process and highlight the immense value of expert audit assistance services.

So, who typically needs audit assistance services? The short answer is: anyone who receives an audit notice from the IRS or a state tax authority, or whose business faces a financial or regulatory examination. This includes:

- Individuals with complex returns: If you have significant deductions, investments, rental properties, or self-employment income, your return might be more likely to catch an auditor's eye.

- Small businesses: From sole proprietors to corporations, businesses face various audits, including income tax, sales tax, and payroll tax audits.

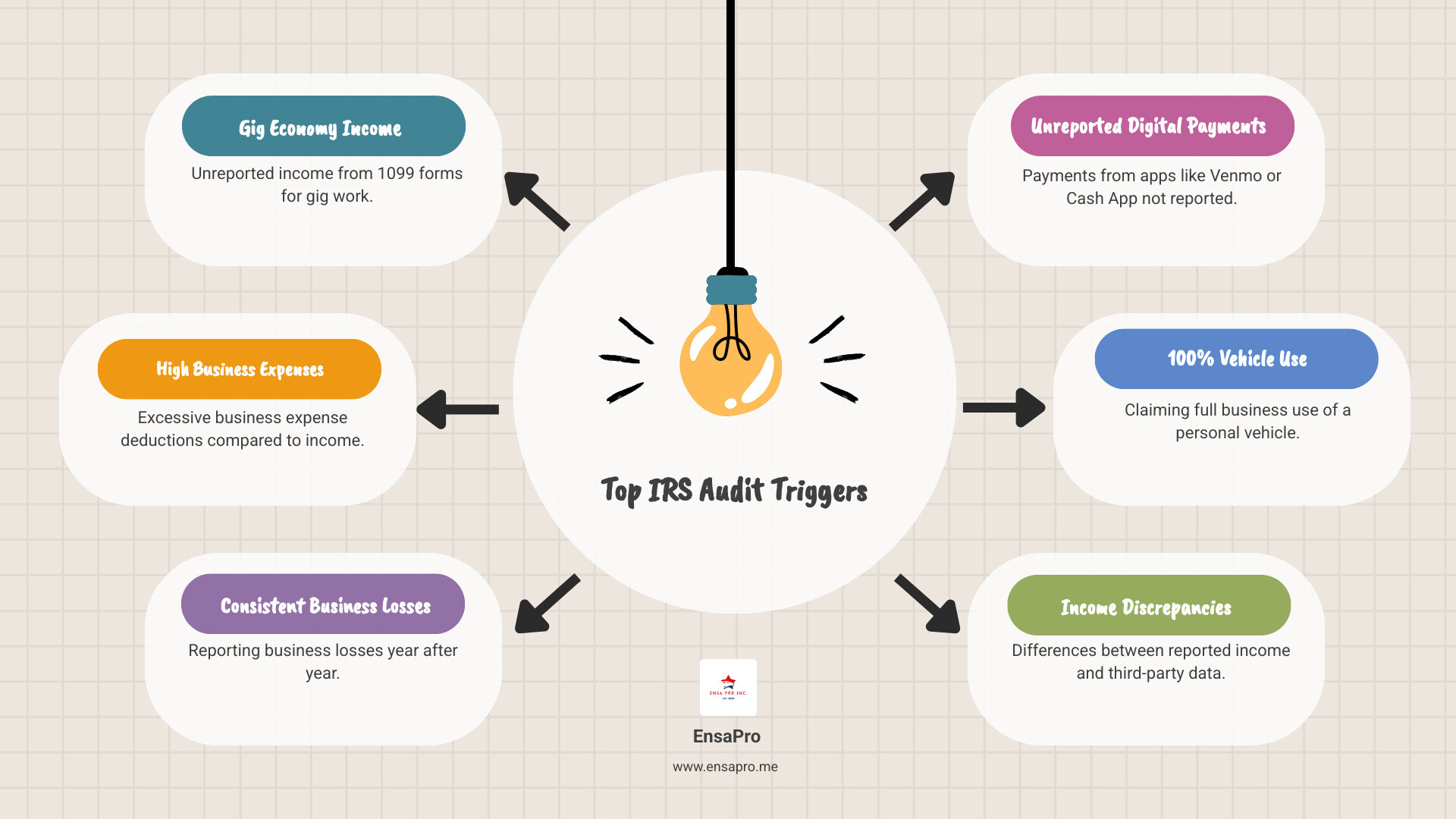

- Gig economy workers: The rise of the gig economy means more independent contractors, freelancers, and app-based workers. Our research shows that common audit red flags for gig economy workers include not reporting all income (especially from 1099s or apps like Zelle/Cash App), claiming excessive expenses, or reporting consistent year-over-year losses.

- Companies facing regulatory audits: This can include industry-specific audits like those from Pharmacy Benefit Managers (PBMs) or compliance reviews like SOX audits.

- Digital asset investors: The complex and evolving nature of cryptocurrency taxation means specialized assistance is often crucial.

Common audit triggers often include discrepancies between reported income and third-party records (like W-2s, 1099s), unusually high deductions compared to income, or a history of large business losses. While some audits are random, many are triggered by these red flags.

The Main Benefits of Using Audit Assistance Services

Facing an audit can be a daunting and stressful experience. It consumes valuable time and mental energy that could be better spent elsewhere. This is where audit assistance services truly shine. Our goal is to transform a potentially overwhelming ordeal into a manageable process with a favorable outcome.

Here are the main benefits you can expect:

- Stress Reduction and Peace of Mind: The thought of an audit alone can cause significant anxiety. Knowing you have experienced professionals in your corner, handling communications and documentation, can provide invaluable peace of mind.

- Expert Representation: Audit professionals understand tax law, accounting principles, and auditor expectations inside and out. They can speak the "language" of the auditors, ensuring your case is presented clearly and effectively. This often involves navigating complex regulations and responding to intricate inquiries.

- Significant Cost Savings: As the statistics show, expert assistance can lead to substantial reductions in potential recoupments or penalties. For instance, in PBM audits, an average reduction of 89% in recoupments translates to significant money saved.

- Error Correction and Prevention: Our experts can identify and correct errors in your records or filings before they become major issues, preventing further complications or penalties. They also ensure appropriate supporting documentation is in place.

- Effective Negotiation with Auditors: Auditors are trained to find discrepancies. Our professionals can skillfully negotiate on your behalf, challenging unfair assessments and advocating for your best interests.

- Improved Outcomes: With expert guidance, you're more likely to achieve a better result, whether it's minimizing additional tax owed, avoiding penalties, or successfully defending your original filing.

- Opportunity Identification: Sometimes, an audit review can uncover missed deductions or credits, turning a defensive situation into an opportunity for unexpected savings.

Who Typically Needs Audit Help?

While anyone can benefit from audit assistance services, certain individuals and entities are more frequently in need:

- Taxpayers with Complex Returns: If your tax situation involves multiple income streams, extensive investments, significant deductions, or foreign assets, you're a prime candidate for professional help when an audit notice arrives.

- Businesses with High Revenue or Complex Structures: Larger businesses naturally have more complex financial records, making them more susceptible to audits. Those with intricate corporate structures or international operations also often require specialized support.

- Self-Employed Individuals and Gig Economy Workers: As noted earlier, the nature of self-employment often leads to unique tax considerations and potential audit triggers. Keeping meticulous records and understanding deductible expenses is crucial, but navigating an audit still requires expertise.

- Companies Facing Regulatory Audits: Beyond income tax, businesses may face audits related to sales tax, payroll tax, or industry-specific regulations (like those in healthcare or finance). These often require specialized knowledge.

- Anyone Receiving an IRS or State Audit Notice: Regardless of your financial situation, receiving an official notice from a tax authority is a clear signal that it's time to seek professional audit assistance services. Don't try to go it alone!

A Closer Look at Different Types of Audit Assistance Services

Audits come in many forms, and so do the audit assistance services designed to help you steer them. From a straightforward tax inquiry to a comprehensive financial statement review, understanding the different types of support available is key to choosing the right help.

Tax Audit and IRS Representation

This is perhaps the most common type of audit assistance individuals and small businesses seek. When you receive a letter from the IRS or your state's tax department, it can be alarming. Our audit assistance services are specifically designed to help you with:

- Understanding IRS Notices: The IRS sends various notices (CP11, CP12, CP14, CP2000, etc.) for different reasons, such as refund status updates, requests for more information, or payment issues. We can help you understand what each notice means and how to respond. The IRS itself provides resources to search for and understand your notice.

- Responding to IRS and State Tax Notices: Prompt and accurate responses are crucial. We can draft professional responses on your behalf, gather necessary documentation, and communicate with the tax authorities. For state tax matters, contacting your specific state's revenue department is essential. In California, you can reach out to the Franchise Tax Board for assistance.

- IRS Representation: If the audit escalates beyond simple correspondence, our professionals can represent you directly before the IRS, advocating for your position and negotiating on your behalf.

- Tax Debt Relief: If an audit results in additional tax owed, we can explore options for tax debt relief, working to reduce your tax owed and handle any remaining liability, including negotiating payment plans. A tax debt resolution expert will do all they can to reduce your tax owed and handle any remaining liability if you end up owing additional taxes, penalties, or interest.

- Relationship with Tax Preparation: Your tax preparation forms the foundation for any audit. Our audit assistance services naturally extend from our meticulous tax preparation, ensuring consistency and accuracy. We can also help if you need to respond to notices for tax years 2019 or earlier. The common need for this type of assistance after filing is why many tax software providers and preparation services offer audit support and paid defense services to their users.

Financial Statement and SOX Audit Support

Beyond tax compliance, businesses often undergo financial statement audits (especially if they're publicly traded or seeking significant investment) and Sarbanes-Oxley (SOX) compliance audits. These audits require a deep understanding of accounting standards and internal controls.

- Financial Reporting and Regulatory Filings: Our audit assistance services can help prepare accurate financial statements, ensure compliance with generally accepted accounting principles (GAAP), and support various regulatory filings. This includes managing restatement remediation and enhancing financial reporting systems.

- SOX Compliance: The Sarbanes-Oxley Act requires public companies to maintain strong internal controls over financial reporting. We can assist with SOX audits by reviewing your internal control framework, preparing documentation, and helping you meet stringent compliance requirements. This involves assessing risk, designing controls, and testing their effectiveness.

- Pre-Audit Reviews: We can conduct pre-audit reviews to identify potential issues, clean up journal entries, technical memos, and accounting policies before external auditors begin their work. This proactive approach can prevent disruptions and reduce the risk of material weaknesses.

- Liaison with External Auditors: Acting as a bridge between your internal team and external auditors, we manage documentation requests (often called "Prepared By Client" or PBC lists), answer inquiries, and streamline communication, allowing your internal finance team to focus on core operations.

- Technical Accounting Memos: For complex transactions, we can prepare detailed technical accounting memos to support your accounting positions, ensuring auditors have a clear understanding of your methodologies.

The Key Differences in Internal vs. External Audit Assistance Services

It's important to distinguish between internal audit support and external audit assistance, as they serve different, though complementary, purposes.

| Feature | Internal Audit Support | External Audit Representation |

|---|---|---|

| Purpose | Enhancing internal controls, operational efficiency, risk management, and governance. | Defending your tax position or financial statements to external parties (IRS, investors). |

| Audience | Management, Board of Directors, Audit Committee. | IRS, state tax authorities, external financial auditors, regulatory bodies. |

| Independence | Functions within the organization, but aims for objectivity. Can be outsourced/co-sourced. | Independent third-party representing you against an external auditor. |

| Scope | Broad, covering operational, financial, compliance, and IT risks. Proactive. | Specific to the scope of the external audit notice (e.g., tax return, financial statements). Reactive. |

| Focus | Future-oriented, process improvement, value creation, internal control effectiveness. | Past-oriented, proving accuracy of historical filings, minimizing liabilities. |

| Relationship | Advisory, partner to management. | Advocacy, representative. |

Internal audit functions, whether in-house or provided through co-sourcing or outsourcing models, focus on continuous improvement and risk assessment within an organization. For instance, professional internal audit services help companies look below the surface to achieve superior performance through a full range of outsourcing, co-sourcing, and advisory services, including technology and data analytics. They aim to improve and protect organizational value through risk-based and objective audit, assessment, and advisory services.

External audit assistance services, on the other hand, are typically engaged when an external entity (like the IRS) initiates an audit. Their role is to represent your interests, prepare your defense, and interact with the auditors to achieve the best possible outcome for your specific audit. They provide independent representation and an objective review of the external auditor's claims.

Navigating the Audit Gauntlet: Preparation and Key Challenges

The thought of an audit can feel like preparing for battle. However, with the right strategy and support, it doesn't have to be a losing fight. Proactive preparedness is your strongest defense, allowing you to minimize disruption, reduce costs, and face auditors with confidence.

Common challenges businesses and individuals face during an audit include:

- Overwhelming Documentation Requests: Auditors often issue extensive "Prepared By Client" (PBC) lists, demanding various financial records, receipts, and explanations. Gathering and organizing this can be a monumental task.

- Complexity of Technical Issues: Understanding the nuances of tax law or accounting standards can be difficult, leading to misinterpretations or incorrect responses.

- Time Constraints: Auditors work on deadlines, and so do you. The pressure to respond quickly and accurately can be immense, diverting focus from your core business or personal responsibilities.

- Emotional Stress: The adversarial nature of an audit can be emotionally draining, making it hard to think clearly and respond effectively.

- Potential for Costly Errors: Mistakes during the audit process, such as providing incomplete or incorrect information, can lead to unfavorable adjustments, penalties, and interest.

This is where expert audit assistance services come in, helping you overcome these challenges with strategic guidance and hands-on support.

Key Considerations When Preparing for an Audit

Preparation is not just about reacting to an audit notice; it's about building good habits year-round.

- Meticulous Record Keeping: This is paramount. Keep thorough records of all income, deductions, and payments. For gig economy entrepreneurs, this includes tracking mileage, business expenses, and all revenue sources. Our Self-Employed Tax Guide for Gig Economy Entrepreneurs emphasizes the importance of keeping all proof of payments for expenses and creating a folder for each expense category.

- Understanding the Scope: When an audit notice arrives, understand what tax years and specific items are being questioned. Don't provide more information than requested unless advised by your representative.

- Assembling Your Team: Don't try to go it alone. Engage professionals who specialize in audit assistance services as soon as you receive a notice.

- Reviewing Past Returns: Our team can review the return in question, identifying potential red flags or areas that might require additional support.

- Identifying Potential Red Flags Proactively: By understanding common audit triggers (like unreported income or excessive deductions), you can ensure your records are impeccable in those areas.

For more information on tax services and how we can help you stay prepared, visit our EnsaPro homepage.

How Support Services Minimize Audit Time and Costs

One of the most tangible benefits of audit assistance services is their ability to significantly reduce the time and financial burden of an audit.

- Efficient Communication: Professionals act as your liaison with auditors, managing all communication and ensuring responses are timely, complete, and accurate. This prevents back-and-forth delays and misunderstandings.

- Organized Documentation: We help you compile and present your documentation in a clear, concise, and auditor-friendly manner. This includes preparing supporting documentation and audit schedules correctly, addressing potential troublesome issues, and cleaning up records before auditors begin inquiries. This proactive approach ensures appropriate supporting documentation is in place.

- Proactive Issue Resolution: Identifying and addressing potential issues before they escalate saves time and prevents auditors from digging deeper than necessary. Pre-audit reviews can prevent disruptions and reduce the risk of material weakness findings.

- Expert Negotiation: Our experience allows for effective negotiation, often leading to quicker resolutions and more favorable outcomes, preventing prolonged audit engagements.

- Preventing Costly Errors: By ensuring accuracy and compliance, we help you avoid additional taxes, penalties, and interest that can arise from audit findings. Remember the PBM audit recoupment example: an average recoupment of $25,350 can be drastically reduced with expert help, saving an average of $22,561. This demonstrates the immense financial value of professional assistance.

Specialized Support for Modern Business Challenges

The business landscape is constantly evolving, bringing with it new complexities and unique audit requirements. From the burgeoning world of digital assets to the intricate web of pharmacy benefit management, specialized audit assistance services are crucial for navigating these modern challenges.

Audit Assistance for Digital Asset Companies

The rise of cryptocurrencies and blockchain technology has introduced entirely new accounting and tax challenges. Digital asset companies, including investment managers, digital asset exchanges, and blockchain platforms, require specialized audit support.

- Cryptocurrency Tax Rules: The tax treatment of cryptocurrencies, NFTs, and other digital assets is complex and constantly changing. We help you understand and comply with rules regarding realized and unrealized gains and losses.

- Blockchain Platform Audits: Auditing transactions on a blockchain requires a unique understanding of the technology. Our services include audit support preparation custom to these platforms.

- Regulatory Filings for Digital Assets: Ensuring compliance with specific regulatory filings for digital assets is critical. We assist with financial reporting and regulatory filings specific to this innovative sector.

- Capitalization Table Preparation: For digital asset companies, accurate capitalization table preparation and equity analysis are vital for financial health and investor relations.

These specialized audit assistance services help digital asset companies steer complex risks and opportunities, ensuring their financial reporting and regulatory compliance are robust.

Support for Contract Reviews and PBM Audits

The pharmacy sector faces its own set of unique audit challenges, particularly from Pharmacy Benefit Managers (PBMs). These audits can be incredibly complex and financially impactful.

- Pharmacy Benefit Manager (PBM) Audits: PBM audits are notorious for their potential to result in significant recoupments. Our research highlights that the average PBM audit recoupment is $25,350, but with assistance, this can be reduced by an average of 89%. This is why audit assistance services are critical for community pharmacy owners.

- Contract Language Pitfalls: PBM contracts are often dense and contain clauses that can lead to audit discrepancies. We can assist with contract reviews to identify potential perils and pitfalls before they become costly issues.

- Invoice Audits: These are common, and our assistance can guide you through the process, ensuring proper documentation and challenging unfair claims.

- Long-Term Care Claims: Audits in this area require meticulous record-keeping and understanding of specific billing codes and regulations. We help implement proactive measures for audit preparedness in long-term care claims.

- Ensuring Compliance and Reducing Recoupments: Services often include providing tools and aids like On-Site Credentialing Guidelines, Patient Affidavits, and Signature Logbooks, along with education on audit trends and tactics. For example, a Virginia Pharmacy reported 23 audits in one year with $0 recoupments after using such services, and an Illinois Pharmacy saved $71,738 by having their recoupment reduced to $0.

These specialized services are designed to support businesses in navigating complex risks and opportunities within their specific industries, ensuring compliance and protecting financial assets.

Choosing Your Audit Ally: What to Look For and What to Expect

When the IRS or another auditing body comes calling, selecting the right audit assistance services provider is one of the most critical decisions you'll make. This choice can significantly impact the outcome of your audit and your peace of mind.

How to Choose the Right Audit Assistance Service Provider

Don't just pick the first name you find. A thoughtful selection process will ensure you partner with an ally who truly understands your needs.

- Assess Your Specific Needs: Are you facing an IRS tax audit, a financial statement audit, or something more specialized like a PBM audit? The type of audit will dictate the expertise required.

- Check Qualifications and Credentials: Look for professionals with relevant credentials such as Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys. These designations signify a high level of expertise and adherence to professional standards.

- Inquire About Experience with Similar Cases: Has the provider successfully handled audits similar to yours? Experience with your specific industry or type of audit (e.g., gig economy taxes, digital asset accounting, small business audits) is invaluable.

- Understand Their Process: Ask about their approach to audit assistance. How do they handle communications with auditors? What is their process for gathering and organizing documentation? A clear, systematic process indicates efficiency and thoroughness.

- Inquire About Communication Protocols: How will they keep you informed throughout the process? Clear and consistent communication is key to reducing stress and ensuring you're always in the loop.

- Review Fee Structures: Understand how they charge for their services. This leads us to the next point...

What is the Typical Cost Structure for Audit Services?

The cost of audit assistance services can vary widely based on the complexity of your case, the experience of the professional, and the scope of work required. Common cost structures include:

- Initial Consultation Fees: Many providers offer a free initial consultation to assess your situation and discuss their services. This is a great opportunity to gauge their expertise and fit.

- Hourly Billing Rates: For more complex or unpredictable audits, professionals may charge an hourly rate. This is common when the exact time commitment is difficult to estimate upfront.

- Flat-Fee Packages: For more straightforward audits or specific services (like responding to a particular IRS notice), a flat fee may be offered. This provides cost certainty.

- Retainer Agreements: For ongoing support or larger engagements, a retainer might be required, with fees drawn against it as work progresses.

- Value-Based Pricing: Some firms may offer pricing based on the value delivered, such as a percentage of the savings achieved in an audit recoupment.

Factors influencing the cost include the number of tax years under audit, the volume of transactions, the complexity of the issues, and the responsiveness of the client in providing documentation. Always get a clear understanding of the fee structure and an estimate of total costs before committing to a provider.

Conclusion: Secure Your Peace of Mind and Financial Future

Navigating an audit can be one of the most challenging experiences for individuals and businesses alike. From the initial shock of receiving an IRS notice to the daunting task of compiling documentation and negotiating with auditors, the process is fraught with potential pitfalls. However, as we've explored, you don't have to walk this path alone.

Audit assistance services offer a lifeline, providing the expert guidance, strategic representation, and meticulous preparation needed to achieve the best possible outcome. We've seen how these services can dramatically reduce potential recoupments, save valuable time, and alleviate immense stress. Whether you're a gig worker, a small business owner, or managing complex digital assets, specialized support ensures your unique needs are met.

The benefits of proactive audit preparedness cannot be overstated. By maintaining diligent records, understanding potential red flags, and engaging professionals early, you transform a reactive crisis into a manageable challenge. Our commitment is to provide personalized, expert audit assistance services that empower you to face any audit with confidence.

Don't let the fear of an audit compromise your peace of mind or your financial future. With EnsaPro, you gain a trusted ally dedicated to protecting your interests and guiding you through every step of the audit process.

Get your free tax return draft and be prepared