Don't Wonder, Know: How to Track Your Tax Refund Online

Why Checking Your Income Tax Refund Status Online Matters

After you file your tax return, the next question is always: Where's my money? Depending on how and where you filed, tax refunds can take anywhere from 8 days to 16 weeks. Fortunately, you don't have to guess. Most tax authorities offer free, real-time tracking tools to monitor your refund's progress.

You can check income tax refund status online in minutes, whether you're waiting on a federal or state refund. These tools show if your return was received, if your refund was approved, and when the money was sent.

Primary Refund Tracking Tools:

- U.S. Federal (IRS): Use the "Where's My Refund?" tool at IRS.gov/refunds or the IRS2Go mobile app. Status is available 24 hours after e-filing or 4 weeks after mailing a paper return.

- California State (FTB): Use the FTB's "Where's My Refund?" tool at FTB.ca.gov.

- Canadian Federal (CRA): Use CRA My Account, the MyCRA mobile app, or the Telerefund phone service (1-800-959-1956).

This guide walks you through exactly how to use these tools, what information you'll need, typical wait times, and what to do if your refund is delayed.

How to Check Your Income Tax Refund Status Online: A Step-by-Step Guide

Tax authorities provide robust online systems to keep you informed. This guide covers the primary methods for tracking your refund with federal and state authorities using the most efficient online tools.

What You Need to Check Income Tax Refund Status Online

Before you begin, gather a few key pieces of information to accurately identify your return. Having these details ready will save time and frustration.

Here's what you'll typically need:

- Your Social Security Number (SSN) or Individual Taxpayer ID Number (ITIN): For Canadian taxpayers, this is your Social Insurance Number (SIN). It's your unique identifier.

- Your Filing Status: The status you used on your return (e.g., Single, Married Filing Jointly, Head of Household).

- The Exact Refund Amount: The precise dollar amount of the refund you claimed. Do not round the figure.

- Your Date of Birth: Required for some services, like the CRA's Telerefund.

- Total Income (Line 15000 of your T1 Tax Return): Required for the CRA's Telerefund service.

Tracking Your Federal (IRS) Refund

The Internal Revenue Service (IRS) offers straightforward ways to check income tax refund status online. The main tool is "Where's My Refund?", which provides clear updates on your federal tax return.

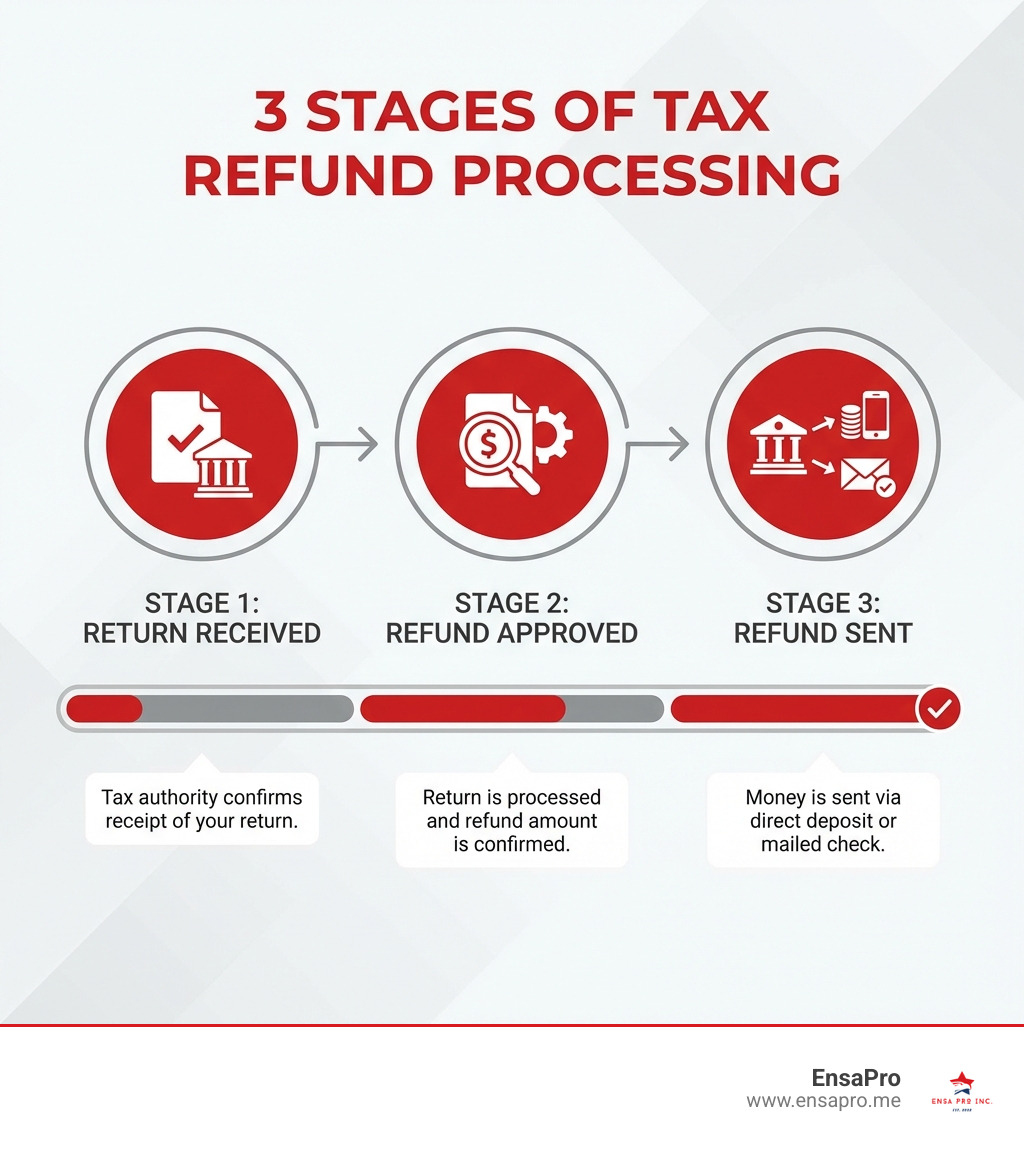

Using the IRS "Where's My Refund?" Tool: Visit the Check your federal refund status page on the IRS website. You'll enter your SSN/ITIN, filing status, and exact refund amount. The system displays your progress through three stages:

- Return Received: The IRS has your tax return.

- Refund Approved: Your return has been processed and the refund amount is confirmed.

- Refund Sent: Your money has been dispatched via direct deposit or a mailed paper check.

Availability and Updates: The status is available within 24 hours for e-filed returns and 4 weeks for mailed returns. The tool is updated once daily, overnight. For mobile access, use the IRS2Go app.

Checking Your State (California) Income Tax Refund Status Online

As a resident of Irvine, California, you must track your state refund separately from your federal one. The California Franchise Tax Board (FTB) has its own dedicated tool for this.

Using the FTB "Where's My Refund?" Tool: To check your California refund, visit the Check your California refund status page. You will need your Social Security Number, filing status, and the exact refund amount from your state return. Federal and state refunds are processed by different agencies on different timelines, so check both independently.

For Canadian Taxpayers: Checking with the CRA

Canadian taxpayers can also check income tax refund status online through the Canada Revenue Agency (CRA).

CRA My Account and MyCRA Mobile App: The best way to check your status is through CRA My Account, a secure portal for all your tax information. The MyCRA mobile app offers the same convenience on your smartphone.

Telerefund Phone Service: For an automated phone service, call Telerefund at 1-800-959-1956. You'll need your SIN, total income from line 15000, and your month and year of birth.

NETFILE Confirmation Number: When you e-file with NETFILE, you get a confirmation number. This proves your return was received by the CRA and is important to keep for your records.

Non-Resident Timelines: Non-resident returns generally take up to 16 weeks to process. It's best to wait this long before contacting the CRA. You can Learn more about CRA processing times on their official site.

Understanding Refund Timelines and Delivery

Understanding typical timelines and how your filing and delivery methods affect them can help manage expectations. Here’s what to expect from the IRS, FTB, and CRA.

Expected Refund Timelines: E-file vs. Paper

Your filing method significantly impacts how quickly you receive your refund. Electronic filing (e-file) is much faster than paper filing, which requires manual processing.

Here's a comparison of typical refund timelines:

| Tax Authority | Filing Method | Expected Refund Timeline |

|---|---|---|

| IRS (Federal) | E-file | Up to 21 days |

| Paper | 4+ weeks (often 6 weeks or more) | |

| FTB (California State) | E-file | Up to 3 weeks |

| Paper | Up to 3 months | |

| CRA (Canadian Federal) | E-file | As soon as 8 business days |

| Paper | Approximately 8 weeks |

E-filing is the clear winner for speed. The IRS issues most e-filed refunds within 21 days, while the CRA can issue them in as few as 8 business days. In contrast, paper returns require patience, with the FTB warning of waits up to 3 months. This is why we at EnsaPro recommend e-filing to ensure speed and reduce the chance of errors.

Direct Deposit vs. Mailed Cheque: The Speed Difference

How your refund is delivered also affects the timeline. You can choose between direct deposit and a mailed cheque.

Direct Deposit: The Fastest Method Direct deposit is the fastest and most secure way to get your refund. The funds are transferred electronically to your bank account once approved. The key is to ensure your bank account and routing numbers are correct on your return to avoid delays. For Canadian taxpayers, you can Set up direct deposit with the CRA through their online portal.

Mailed Cheque: The Slower Option A mailed cheque is a reliable but slower option. The process of printing and mailing the check adds several weeks to your wait. For example, the CRA estimates mailed cheques take 4-6 weeks to arrive after processing. Mailed cheques also risk being lost, stolen, or damaged, which can lead to further delays while you request a replacement. For speed and security, direct deposit is the superior choice.

Troubleshooting: What to Do If Your Refund Is Delayed

If your refund hasn't arrived within the expected timeframe, don't panic. There are common reasons for delays and clear steps you can take to investigate.

Common Reasons for a Tax Refund Delay

Various factors can slow down your refund. Understanding them can help you diagnose a potential issue.

- Errors on Your Return: A simple mistake, like an incorrect SSN or a miscalculation, can flag your return for manual review.

- Missing Information: Incomplete returns or those lacking required documents will be put on hold.

- Identity Verification: To combat fraud, agencies may hold a refund to verify your identity, often by sending a letter.

- Refund Offset for Debts: Your refund can be reduced or used to pay outstanding government debts, such as unpaid child support or defaulted student loans.

- Detailed Review: Your return may be selected for a more in-depth examination, which significantly extends processing time. The CRA provides information on what a Detailed review of your tax return entails.

- Specific Tax Credits: Claims for certain credits like the EITC may require additional verification.

- Amended or Non-Resident Returns: These have inherently longer processing timelines.

If you experience a delay, first check income tax refund status online. The tracker may provide a reason or indicate if you need to take action.

How to Check the Status of an Amended Return

Filing an amended return (Form 1040-X for federal) to correct a mistake involves a different, longer tracking process.

- Separate Tracking Tool: Amended returns are not tracked with the standard "Where's My Refund?" tool. The IRS has a dedicated "Where's My Amended Return?" portal.

- Longer Processing Time: Be prepared to wait. Amended returns are reviewed manually and can take up to 16 weeks or more to process, a significant increase from the 21-day timeline for original e-filed returns.

When and How to Contact the Tax Authorities

If you've waited the recommended time and the online status is unclear, it may be time to contact the tax authority directly.

Wait the Recommended Time: Before calling, ensure you've waited beyond the standard processing window:

- IRS: 21+ days for e-file, 4+ weeks for paper, 16+ weeks for amended returns.

- FTB (California): 3+ weeks for e-file, 3+ months for paper.

- CRA (Canada): 8+ business days for e-file, 8+ weeks for paper, 16+ weeks for non-residents.

What to Have Ready for the Call: Have a copy of your tax return and personal information (SSN/SIN, date of birth, address, filing status, and exact refund amount) ready to verify your identity.

Contact Information:

- IRS (Federal): 1-800-829-1954 (automated) or 1-800-829-1040 (representative).

- FTB (California State): 1-800-852-5711.

- CRA (Canadian Federal): 1-800-959-1956 (Telerefund) or Contact the CRA directly for other inquiries.

Frequently Asked Questions about Checking Your Refund

Here are answers to some of the most common questions about tracking your tax refund.

Why does the "Where's My Refund?" tool say my information is incorrect?

This common error usually has a simple cause. Check for the following:

- Data Entry Errors: Double-check that your Social Security Number (SSN), filing status, and exact refund amount are correct. Do not round the refund amount.

- Incorrect Filing Status: Ensure you've selected the precise filing status from your return (e.g., "Single" vs. "Head of Household").

- Waiting Period: You may be checking too soon. Wait at least 24 hours after e-filing or 4 weeks after mailing a paper return before checking the IRS tool.

- Prior Year Information: Make sure you are using information for the correct tax year.

If you've verified these details and still see an error, wait 24 hours and try again. If the issue persists, review your tax return copy for discrepancies.

Can my tax refund be taken to pay off other debts?

Yes, your tax refund can be intercepted or "offset" to pay certain delinquent debts. This is a common government practice.

- Treasury Offset Program (TOP): The IRS uses this program to collect debts owed to federal and state agencies. Common debts include past-due child support, defaulted student loans, and state income tax obligations.

- Spousal Debt: If you file a joint return, your refund can be used to pay a debt owed solely by your spouse. You may be able to reclaim your portion by filing an "Injured Spouse Claim" (Form 8379).

- Notice of Offset: If your refund is offset, you will receive a notice from the Bureau of the Fiscal Service explaining the reason and the amount taken.

If you have outstanding government debts, it's wise to anticipate that your refund may be offset.

How does the government pay interest on a delayed refund?

In some cases, if the government holds your refund for too long, it is required to pay you interest.

- Conditions for Payment:

- IRS (Federal): The IRS generally pays interest if it doesn't issue your refund within 45 days of the later of the tax deadline or your filing date.

- CRA (Canadian Federal): The CRA pays interest on refunds held for more than 30 days after the return was filed.

- Interest Accrual: Interest begins accruing after the 45-day (IRS) or 30-day (CRA) window closes and continues until the refund is issued.

- Exceptions: Interest is not paid on all delays. For instance, if your return is held for a detailed review or audit, the rules for interest may change. Receiving interest is a small consolation for a delay, but it compensates taxpayers when the government misses its processing deadlines.

Get Your Refund Faster and With Fewer Headaches

Navigating tax refunds is easier when you know where to look. The key is using the available online tools to check income tax refund status online and stay informed.

Here's a quick recap of best practices for a smooth refund experience:

- E-File for Speed: Electronic filing is faster and more accurate than paper.

- Choose Direct Deposit: Receive your refund in days, not weeks. Always double-check your bank information.

- Be Prepared: Have your SSN/SIN, filing status, and exact refund amount ready before checking your status.

- Know the Timelines: Understand the processing times for e-filed vs. paper returns before you worry.

- Use the Right Tools: Use the official IRS, FTB, and CRA websites, and remember the separate tool for amended returns.

- Double-Check Your Return: Accuracy is critical to avoiding delays.

At EnsaPro, we know tax season can be overwhelming. We offer personalized tax preparation to eliminate the guesswork and ensure you get the best outcome. We even help with IRS status checks, so you're never left wondering. Our thorough, personalized approach means we handle the complexities for you.

Ready for a tax season with fewer headaches? Let us help ensure your return is accurate and your refund arrives smoothly.

Get a free draft of your tax return