The Best Crypto Tax Filing Services for a Smooth Season

Why Crypto Tax Filing Service Matters for US Investors

A crypto tax filing service can save you from costly mistakes and IRS penalties. Here are your main options for filing crypto taxes in the US:

Software Solutions - Best for straightforward portfolios with under 10,000 transactions. Connects to hundreds of exchanges and wallets, automatically calculates capital gains using various cost basis methods, and generates necessary tax forms like Form 8949. Prices typically start free with paid plans for filing.

Specialized Accounting Firms - Best for complex situations like DeFi, NFTs, high-volume trading, or unfiled prior years. Provides audit support, personalized tax strategy, and can amend returns for previous years.

DIY with General Tax Software - Only suitable if you have very few transactions and can manually calculate gains/losses.

Since the Infrastructure Investment and Jobs Act, reporting requirements for cryptocurrency brokers have been improved, meaning the government has more visibility into crypto transactions. This means the IRS is actively conducting audits of crypto investors and traders, using surveillance software to trace blockchain transactions. The stakes have never been higher for accurate crypto tax reporting.

Many Americans who started trading crypto years ago haven't filed taxes on their transactions. Others struggle with complex scenarios like crypto-to-crypto trades, staking rewards, or NFT sales. The tax treatment depends on whether your activity is classified as capital gains or business income—a distinction that can significantly impact what you owe.

This guide breaks down your options for filing crypto taxes in the US, from automated software solutions to working with specialized accountants. We'll cover when each approach makes sense, what features to look for, and how to handle advanced situations like mining, DeFi, and even losses from crypto scams.

Understanding Your Crypto Tax Obligations in the US

The world of cryptocurrency is exciting, but it's not a tax-free zone. In the United States, the Internal Revenue Service (IRS) views cryptocurrency as property, much like stocks or gold, rather than legal tender. This classification is crucial because it dictates how your crypto activities are taxed. Essentially, every time you sell, trade, spend, receive, mine, or stake cryptocurrency, you're likely creating a taxable event.

As US taxpayers, we have a clear responsibility to report all our cryptocurrency transactions. Failing to do so can lead to significant penalties and unwanted audits. The IRS isn't sitting idly by; they are actively conducting audits of those investing and trading in crypto-assets. The IRS is continuously improving its crypto-related compliance efforts. They're not just relying on good faith—they're using surveillance software to trace transactions on the blockchain. The blockchain is an open ledger, making it easier for authorities to track movements from fiat conversions onwards. Furthermore, exchanges operating in the US are subject to reporting requirements from agencies like FinCEN and must disclose client information to the government (KYC). This means the IRS has an increasingly clear picture of who's doing what in the crypto space. So, ignoring your crypto taxes isn't just risky; it's practically an invitation for a closer look from the taxman.

Capital Gains vs. Business Income: What's the Difference?

One of the most common questions we hear is whether our crypto activities should be reported as capital gains or business income. This distinction is vital because it affects your tax rate. Generally, if you're buying and selling crypto occasionally with the intent to hold it as an investment, any profits or losses are typically treated as capital gains or losses. Long-term capital gains (on assets held for more than a year) are taxed at a lower rate than short-term gains (held for a year or less), which are taxed as ordinary income.

However, if your crypto activities are frequent, organized, or carried out with a clear profit motive—think day trading, running a mining operation, or actively staking large amounts of crypto—the IRS may consider this business income. Business income is fully taxable at your ordinary income tax rate. This applies to activities like mining and staking rewards as well; if you're doing them consistently with an expectation of profit, they're likely business income. For capital gains, you'll report these on Form 8949 and Schedule D of your Form 1040 tax return. For business income, it's reported on a Schedule C, Profit or Loss from Business.

Key Tax Dates and Deadlines

Staying on top of tax deadlines is crucial for all US taxpayers, and crypto investors are no exception. The general personal income tax filing deadline for most Americans is April 15th each year. If you need more time to file, you can request an extension, which typically pushes the deadline to October 15th. However, an extension to file is not an extension to pay; any taxes owing are still due by the original April 15th deadline.

Beyond your regular income tax return, there are other important forms to be aware of. If you have a financial interest in or signature authority over foreign financial accounts (which can include crypto held on foreign exchanges) and the aggregate value exceeds $10,000 at any time during the year, you must file a FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). Additionally, you may need to file Form 8938, Statement of Specified Foreign Financial Assets, if the total value of your foreign assets exceeds certain thresholds. Failing to file these forms can result in significant penalties.

The DIY Approach: Using Crypto Tax Filing Service Software

For many crypto investors, especially those with simpler portfolios, using a specialized crypto tax filing service software is an excellent, cost-effective solution. These platforms are designed to automate the often-tedious process of tracking transactions and calculating your tax obligations. They're a digital superhero for your crypto taxes!

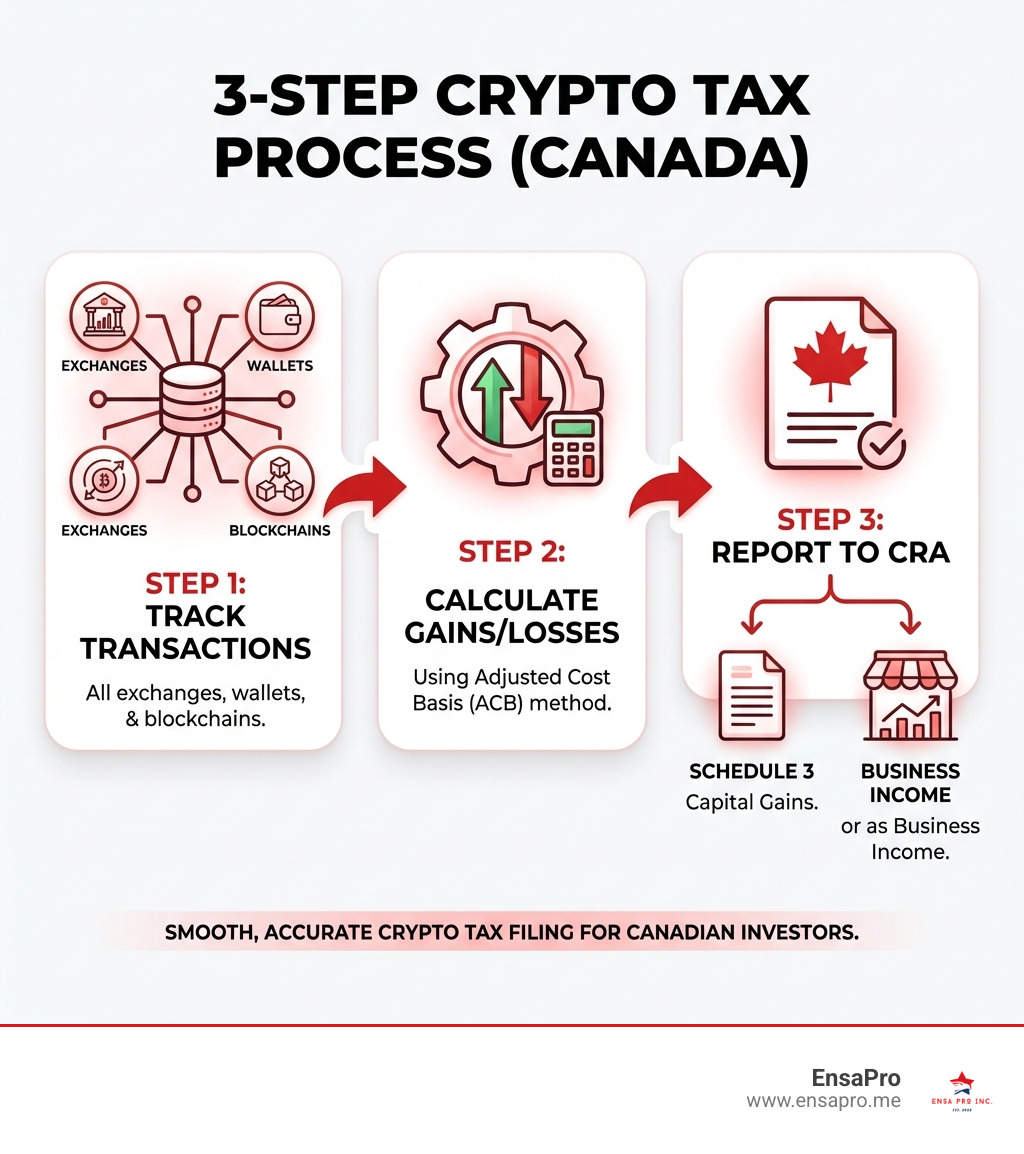

The primary role of these software solutions is to simplify your crypto tax filing. They work by aggregating all your transactions from various exchanges, wallets, and blockchains, and then performing the complex calculations required by tax authorities. This automation is a massive benefit, saving you countless hours of manual data entry and spreadsheet wrestling. For instance, many platforms connect to hundreds of crypto platforms to track transactions and calculate US crypto taxes fast. Many also boast support for a vast number of exchanges, wallets, and blockchains, along with thousands of smart contracts and dapps. Many even offer a generous free plan, which allows you to import a large number of transactions and provides a free tax preview. This makes them ideal for individuals with a relatively straightforward portfolio who want to manage their taxes accurately without breaking the bank.

Key Features to Look for in a Crypto Tax Filing Service

When choosing a crypto tax filing service software, certain features can make a world of difference in accuracy and ease of use. Here's what we recommend keeping an eye out for:

- Extensive Integrations: The more exchanges, wallets, and blockchains a service connects to, the less manual work you'll have. Look for platforms that support hundreds of integrations.

- Cost Basis Calculation: This is critical for US tax purposes. Your chosen software must accurately calculate your cost basis using methods like First-In, First-Out (FIFO) or Highest-In, First-Out (HIFO).

- Generation of Form 8949: A huge time-saver! Software that can generate a completed Form 8949 for capital gains will make integrating your crypto taxes into your overall return much smoother.

- Integration with Popular Tax Software: Many services offer direct integration with popular tax software, simplifying the final filing step.

- Free Tax Preview: This allows you to see your tax liability before committing to a paid plan, giving you peace of mind.

How Software Simplifies Complex Calculations

The true power of a crypto tax filing service software lies in its ability to handle the intricate calculations that can quickly become overwhelming.

- Automating Crypto-to-Crypto Trades: Exchanging one cryptocurrency for another (e.g., Bitcoin for Ripple) is considered a taxable event, just like selling for fiat. The software automatically treats this as a sale of the first crypto at the market price of the second crypto received, calculating the gain or loss.

- Tracking Wallet Transfers: Transferring crypto between your own wallets isn't a taxable event, provided you own both wallets. However, you still need to track the original cost basis of the transferred coins. Good software excels at matching these transfers between your own wallets, ensuring your cost basis is maintained correctly without triggering unnecessary tax events.

- Applying the Wash Sale Rule: This US rule prevents you from selling a security at a loss and then repurchasing a "substantially identical" one within 30 days before or after the sale. While the rule's application to crypto is still being clarified by the IRS, good tax software will often have features to identify and flag these potential wash sales.

- Calculating Gains & Losses Accurately: These platforms are specifically built to understand if a transaction was a capital gain, a loss, income, or a non-taxable event, taking into account market prices at the time of your trades. This level of precision is virtually impossible to achieve manually for active traders.

Using a specialized crypto tax calculator can save you hours of work and ensure accuracy. If you're looking for assistance with tax preparation, we can help you integrate these calculations into your overall tax strategy. Use a crypto tax calculator.

The Professional Touch: Working with a Crypto Tax Specialist

While software offers incredible convenience, some situations call for the nuanced expertise of a human professional. A specialized crypto tax filing service provided by an accountant or tax lawyer can be invaluable for complex portfolios or when navigating tricky IRS waters.

The benefits of engaging a crypto tax accountant are numerous. They can dig into the specifics of your transactions, offer personalized tax strategies, and even represent you during an IRS audit. Software, while powerful, may not be ideal for every unique situation, and professional advice can be the difference between overpaying or underpaying your taxes. If you've made mistakes in past filings, a crypto tax lawyer can help correct them and mitigate potential penalties. They can also amend prior tax returns, generally up to three years back, which is a huge relief for those who might have overlooked crypto reporting in previous years. If you haven't filed any returns at all, they can help you get caught up and compliant.

When Do You Need a Professional Crypto Tax Filing Service?

So, how do you know when it's time to call in the cavalry? Here are some scenarios where a professional crypto tax filing service is highly recommended:

- High-Volume Trading: If you're a serious crypto trader with hundreds or thousands of transactions, especially across multiple platforms, the complexity can quickly exceed what software can easily manage or what you feel comfortable verifying.

- DeFi and Yield Farming: Decentralized Finance (DeFi) activities, including yield farming, liquidity providing, and complex lending protocols, introduce unique tax challenges that often require expert interpretation.

- NFT Creation and Trading: The tax treatment of NFTs (Non-Fungible Tokens), including sales, royalties, and creation costs, can be intricate and may fall under capital gains or business income depending on your activities.

- Unfiled Crypto Taxes from Prior Years: If you haven't reported your crypto activities in previous tax years, a specialist can guide you through the process of amending returns or utilizing programs like the IRS's Voluntary Disclosure Practice.

- Facing an IRS Audit: This is perhaps the most critical time to engage a professional. An IRS tax audit can be intimidating, but a crypto tax lawyer can help minimize your costs and steer the audit process effectively.

What to Expect When Working with a Specialist

When you decide to work with a crypto tax specialist, they'll typically start with an initial consultation to understand your situation. Be prepared to provide comprehensive documentation. This usually means providing API keys for all the exchanges you've used. If API keys aren't available, then detailed transaction downloads in CSV or Excel formats will be essential.

A specialist can also help amend prior tax returns, generally going back three years, to correct any past omissions or errors. This process can be complex, but with expert guidance, you can achieve compliance and potentially reduce penalties. Furthermore, many specialists are flexible: they can either work in conjunction with your present accountant or you can use their in-house accounting services if you don't already have a tax professional. If you prefer to file your own taxes using general tax software, a specialist can still provide you with the required numbers and reports to ensure accuracy. If you need help, don't hesitate to reach out. We can provide general tax preparation assistance and help you find the right crypto tax specialist if needed. Contact a specialist for help.

Navigating Advanced Crypto Tax Scenarios

The crypto landscape is constantly evolving, bringing new innovations and, naturally, new tax questions. Beyond simple buying and selling, activities like mining, staking, and trading NFTs introduce distinct tax implications. The key to navigating these advanced scenarios is understanding the specific tax treatment of each activity, accurately valuing rewards or assets in US dollars at the time of receipt, and establishing a clear cost basis for future transactions. This proactive approach helps us report income versus capital gains correctly.

Mining, Staking, and Airdrops

For those involved in mining, staking, or receiving airdrops, the tax implications can vary significantly based on the nature and scale of your activities:

- Mining: If you're mining crypto as a hobby, the income might be treated differently than if you're running a professional-grade mining operation with a profit motive. The latter would likely be considered business income, fully taxable. The value of the mined crypto in USD at the time it's received is your income.

- Staking: Similar to mining, staking rewards are generally considered income (either business or other income) at the fair market value in USD on the day you receive them.

- Airdrops: When you receive an airdrop, its fair market value in USD at the time of receipt is usually considered income.

For all these activities, establishing the cost basis of the earned coins is crucial. This value will be used later to calculate any capital gain or loss when you eventually sell or trade those coins.

The Tax Implications of NFTs and Crypto Scams

NFTs have exploded in popularity, but their tax treatment in the US is still evolving. Generally, NFTs are treated as capital property. This means that if you sell an NFT for a profit, you'll likely incur a capital gain. If you create and sell NFTs frequently, or earn royalties from your creations, this could be considered business income, which is fully taxable.

On a more somber note, the crypto world has also seen its share of scams and exchange collapses, like the implosion of FTX. If you've been scammed or lost crypto due to an exchange failure, there may be recourse for tax purposes. Losses from such events can trigger capital or business losses, which can be used to offset other gains or income. However, proving these losses requires meticulous record-keeping, detailing the circumstances and situation that led to the loss. This highlights the importance of dealing with stable, registered exchanges and securing your investments in cold storage wallets, especially for long-term investors. The regulatory framework is still developing, but keeping robust records is your best defense. You can learn more about such events by reviewing Lessons from the FTX implosion.

Best Practices for Compliance and Tax Minimization

Navigating crypto taxes might seem daunting, but with a proactive approach and diligent record-keeping, we can stay compliant and even minimize our tax liability. Understanding how the IRS tracks cryptocurrency transactions and adopting best practices for organization are key to a smooth tax season.

The IRS is increasingly sophisticated in its ability to monitor crypto activities. As we've discussed, every transaction is recorded on the blockchain, and US exchanges are required to report client information. This means the IRS has powerful tools at its disposal, including surveillance software, to trace transactions. Therefore, a strategy of "hoping they don't find out" is not a viable one. Instead, let's focus on proactive compliance.

Impeccable Record-Keeping for Crypto Taxes

Our golden rule for crypto taxes is simple: record, record, record! Good record-keeping is your best friend, especially in the event of an audit. You should keep a detailed log of every single crypto transaction, including:

- Transaction Dates: The exact date and time of every buy, sell, trade, or transfer.

- Value in USD: The fair market value in US dollars at the exact time of the transaction.

- Transaction Purpose: Whether it was a purchase, sale, trade, gift, payment, mining reward, staking reward, etc.

- Wallet Addresses: The sending and receiving wallet addresses for transfers.

- Transaction IDs: Unique identifiers for each transaction on the blockchain or exchange.

- Exchange Records: Downloadable trade histories from all exchanges.

Digital record-keeping is often the most efficient way to manage this. Store everything in organized folders, ideally backed up securely. The IRS provides guidance on keeping records, emphasizing the importance of maintaining proper documentation.

The Voluntary Disclosure Practice and Foreign Reporting

If you've realized you have unfiled crypto taxes or made errors in previous returns, don't panic. The IRS's Voluntary Disclosure Practice might be your lifeline. This program is a way for taxpayers to come forward and correct previously unreported or inaccurately reported income. If your application is accepted, you can achieve tax compliance and potentially avoid criminal prosecution, though you will still have to pay back taxes, interest, and penalties.

Additionally, we must reiterate the importance of foreign reporting. If you hold cryptocurrency on a foreign exchange, you may have reporting obligations. If the total value of your foreign financial accounts exceeds $10,000 at any point during the year, you must file a FinCEN Form 114 (FBAR). Separately, you may need to file Form 8938 if your specified foreign assets meet certain thresholds. The penalties for failing to file these forms can be substantial, as detailed on the IRS's website regarding FBAR. These regulations underscore the need for vigilance and accurate reporting, especially for significant crypto holdings.

Conclusion

Navigating the complexities of cryptocurrency taxation in the United States doesn't have to be a source of constant anxiety. Whether you opt for a DIY approach with robust crypto tax filing service software or seek the personalized guidance of a specialist, the key is accurate and timely compliance.

Software solutions offer an excellent starting point for simplifying transaction tracking and calculations, particularly for those with less intricate portfolios. They automate much of the heavy lifting, from integrating with numerous platforms to applying complex US tax rules like cost basis accounting and the Wash Sale Rule.

However, for more complex scenarios—such as high-volume trading, deep dives into DeFi, NFT creation, or rectifying past omissions—a specialized crypto tax accountant or lawyer provides invaluable expertise. They offer personalized strategies, audit support, and the ability to amend prior tax returns, ensuring you're fully compliant and minimizing your tax liability.

The choice of crypto tax filing service depends on your individual circumstances and comfort level. But regardless of your chosen path, the importance of accurate record-keeping and understanding your tax obligations cannot be overstated, especially with the IRS's increasing scrutiny.

At EnsaPro, we understand that tax preparation can be overwhelming. While we specialize in general tax preparation services, we are committed to helping you achieve the best possible outcome for your tax situation. We offer a thorough, personalized approach to ensure your tax returns are accurate and optimized. If you need expert help with your tax preparation, we're here to guide you. Get expert help with your tax preparation.