The Savvy Self-Employed's Secret Weapon: A Deduction Worksheet for Every Dollar

Why Every Self-Employed Person Needs a Tax Deduction Worksheet

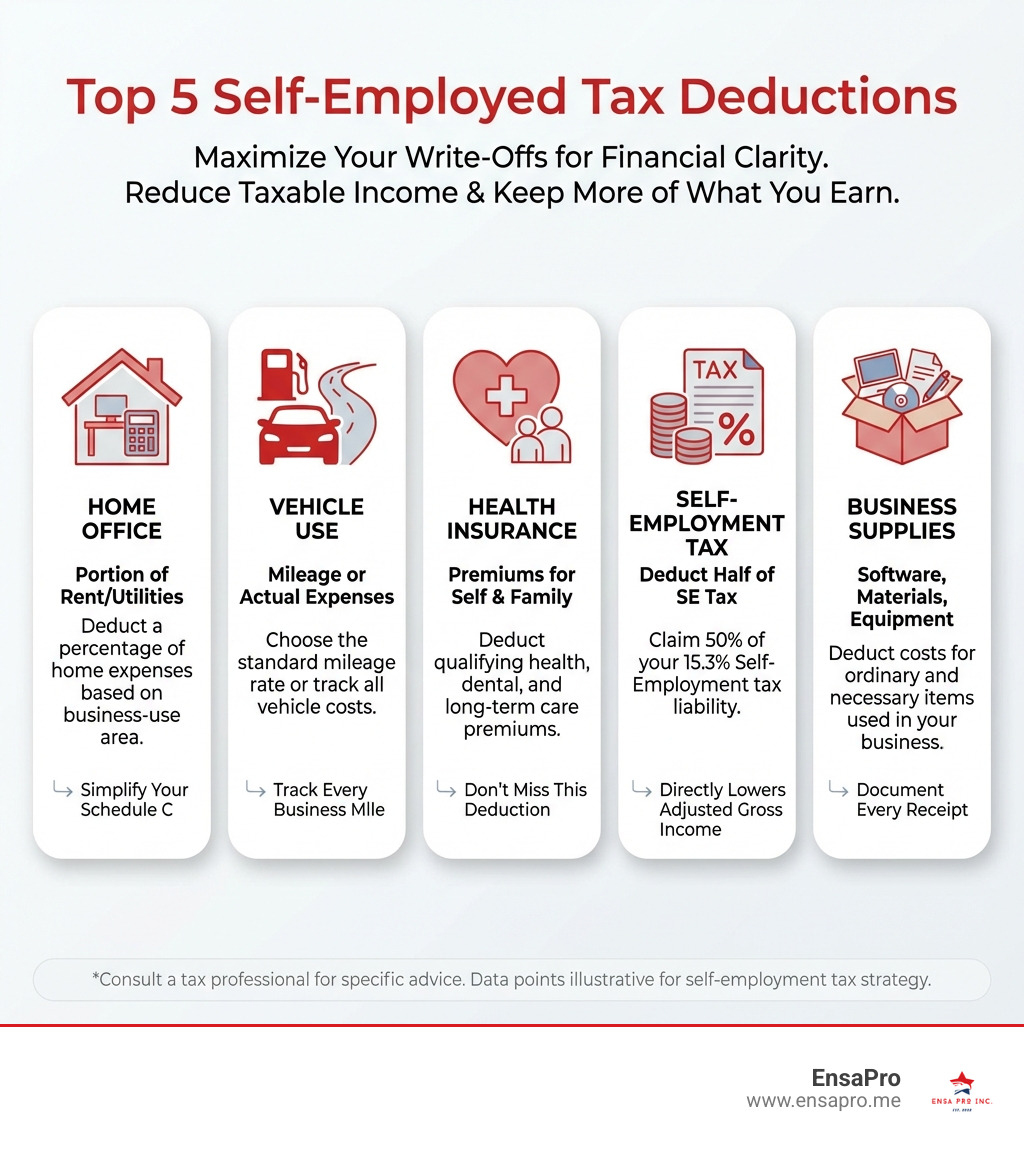

A self-employed tax deductions worksheet is your roadmap to tracking every business expense you can legally deduct, helping you lower your tax bill and keep more of what you earn. If you're searching for one, here's what you need to know right now:

What a Self-Employed Tax Deductions Worksheet Does:

- Organizes all your business expenses into IRS-approved categories

- Tracks vehicle mileage and home office costs (the two biggest deductions)

- Documents receipts and proof of payment for every claimed expense

- Simplifies the process of completing Schedule C (Form 1040)

- Ensures you don't miss common deductions like health insurance, software, or professional fees

Most Important Categories to Track:

- Home office expenses (rent, utilities, internet)

- Vehicle use (mileage or actual costs)

- Health insurance premiums

- Office supplies and equipment

- Professional fees and subscriptions

At the end of the tax year, most self-employed individuals scramble to remember what they spent on business-related activities. The stress is real. According to data from tax preparation services, users who systematically track their deductions typically save $5,600 from their tax bill.

The difference between those who save big and those who leave money on the table? Organization.

When you're self-employed, you don't have an employer withholding taxes or tracking expenses for you. You're responsible for calculating your self-employment tax (15.3% on net earnings), paying quarterly estimated taxes, and proving every deduction you claim. Without a clear system, you'll either overpay the IRS or risk penalties during an audit.

A deduction worksheet isn't just about tax season—it's your year-round tool for financial clarity. It helps you see where your money goes, plan for tax payments, and maximize every legitimate write-off the IRS allows.

Whether you're a freelance graphic designer, rideshare driver, consultant, or online retailer, the rules are the same: track everything, categorize correctly, and keep proof. The IRS defines deductible expenses as "ordinary and necessary" for your business. If you can't prove it, you can't deduct it.

Let's break down exactly how to build and use a worksheet that captures every dollar you're entitled to deduct.

The Foundation: Understanding Self-Employment Tax Obligations

Being your own boss comes with incredible freedom, but it also means taking on the tax responsibilities traditionally split between an employer and employee. This is where understanding your self-employment tax obligations becomes paramount, and why deductions are so important.

Why do deductions matter? Simply put, they lower your taxable income. Every dollar you can legally deduct as a business expense reduces your net profit, which in turn reduces the amount of income tax and self-employment (SE) tax you owe. This directly impacts your overall tax liability, saving you real money.

The Self-Employment (SE) Tax is your contribution to Social Security and Medicare. For self-employed individuals, this rate is 15.3% on your net earnings from self-employment. This 15.3% is broken down into 12.4% for Social Security (up to an annual income limit, which for 2025 is $176,100) and 2.9% for Medicare (with no income limit). The good news? The IRS lets you deduct half of this 15.3% self-employment tax (which is 7.65%) from your gross income, further reducing your tax burden.

To manage these obligations, you'll primarily use two key IRS forms:

- Schedule C (Form 1040), Profit or Loss from Business: This is where you report your business income and expenses to determine your net profit or loss.

- Schedule SE (Form 1040), Self-Employment Tax: This form calculates your Social Security and Medicare taxes based on your net earnings from Schedule C.

An expense is considered "ordinary and necessary" by the IRS if it is common and accepted in your industry (ordinary) and helpful and appropriate for your business (necessary). It doesn't have to be indispensable to be considered necessary. Keeping meticulous records helps you justify that your expenses meet these criteria.

How do these deductions impact your overall tax liability? By reducing your net profit, they directly lower your Adjusted Gross Income (AGI). A lower AGI can lead to a lower income tax bill and potentially qualify you for other tax credits or deductions.

It's also crucial to understand the implications of a net profit versus a net loss. If your business has a net profit of $400 or more, you must pay SE tax. A net loss, however, can usually be deducted from your gross income, though there might be limitations in certain situations.

Finally, since you don't have an employer withholding taxes, you're generally required to pay quarterly estimated taxes using Form 1040-ES. This ensures you pay your income and self-employment taxes throughout the year, avoiding a big tax bill—and potential penalties—at year-end.

Who is Considered Self-Employed?

You might be wondering if this applies to you. Generally, you are self-employed if you are in business for yourself. This includes:

- Sole proprietors: Individuals who own an unincorporated business by themselves.

- Independent contractors: People who perform services for others but are not employees.

- Freelancers: Often similar to independent contractors, providing specialized services.

- Gig workers: Individuals earning income through on-demand platforms (e.g., rideshare drivers, delivery services).

- Single-member LLCs: Unless you've elected for your LLC to be taxed as a corporation, you're generally treated as a sole proprietor for tax purposes.

- Partnership members: If you're part of a partnership that conducts a trade or business.

The key threshold for federal tax purposes is having net earnings of $400 or more from self-employment. If you hit this amount, you're on the hook for self-employment tax and need to report your income and expenses. Even if it's a part-time side hustle, if it's "profit-driven" and meets the $400 threshold, it counts!

The Role of Key Tax Forms

Navigating self-employment taxes involves a few essential forms, each playing a critical role in accurately reporting your income and deductions:

- Schedule C (Form 1040), Profit or Loss from Business: As mentioned, this is your primary form for reporting business income and expenses. Part I details your gross income, while Part II is where you list all your deductible business expenses, categorized for clarity. This form ultimately calculates your net profit or loss, which flows directly to your personal Form 1040.

- Schedule SE (Form 1040), Self-Employment Tax: Once your net earnings from Schedule C are determined, Schedule SE uses that figure to calculate your Social Security and Medicare tax liability. It also includes the calculation for the deductible portion of your self-employment tax.

- Form 1040-ES, Estimated Tax for Individuals: This form helps you calculate and pay your quarterly estimated taxes. If you expect to owe $1,000 or more in tax for the year, you'll need to make these payments throughout the year to avoid penalties.

- Form 1099-NEC, Nonemployee Compensation: If you pay an independent contractor (not an employee) $600 or more for services during the tax year, you are generally required to file a Form 1099-NEC with the IRS and provide a copy to the contractor. This ensures proper reporting of income for both parties.

These forms, especially Schedule C, are where your diligently prepared self-employed tax deductions worksheet truly shines, providing all the organized data you need at your fingertips.

Building Your Ultimate Self-Employed Tax Deductions Worksheet

The goal of a self-employed tax deductions worksheet is simple: to track every dollar of business income and expense. Think of it as your personal financial assistant, ensuring you don't miss out on valuable write-offs. By organizing expenses by category, you simplify your life come tax time, making the process less of a headache and more of a strategic exercise. Whether you prefer a physical ledger or a digital spreadsheet, the key is consistency and detail.

Key Categories for Your self-employed tax deductions worksheet: Office & Operations

This section covers the essential costs of keeping your business running.

- Office supplies: Everything from pens and paper to printer ink and postage. If you purchased supplies specific to your industry (e.g., photography backdrops, art canvases), those count too.

- Software and subscriptions: Any software used for business (e.g., accounting software, design programs, project management tools) and subscriptions to industry-related services or publications are deductible.

- Business insurance premiums: Premiums for business liability insurance, professional malpractice insurance, and even health insurance (more on this later) can be deductible.

- Legal and professional fees: Payments to CPAs, tax preparers (like us at EnsaPro!), lawyers, consultants, or other professionals for business advice or services.

- Business licenses and permits: The costs associated with obtaining and renewing licenses and permits required to operate your business.

- Bank fees and merchant processing fees: Fees charged by your business bank account, credit card processing fees (e.g., Stripe, PayPal), and ATM fees for business withdrawals.

- Rent for business property: If you rent an office, studio, or workshop separate from your home, the rent is 100% deductible.

- Utilities for a separate business location: Electricity, gas, water, and trash services for a dedicated business space.

Key Categories: Travel, Meals, and Client Growth

These categories often involve specific rules, so careful tracking is essential.

- Business travel expenses: When you travel away from your "tax home" (your main place of business) for business purposes, you can deduct costs like airfare, baggage fees, lodging, car rentals, taxis, and public transportation. Remember to keep detailed logs and receipts.

- Business meals: The most important thing to know is that business meals are generally only 50% deductible. This applies whether you use the actual cost method or the standard meal allowance. This includes meals with clients, during business meetings, or while traveling for business.

- Client gifts: You can only write off $25 per person per year for gifts given to clients or associates. If you give a client a $50 gift, you can only deduct $25.

- Advertising and marketing costs: The cost of telling the world about what you do can quickly add up, and the good news is you can write off advertising expenses. This includes online ads (Google Ads, social media ads), print ads, promotional materials, and public relations. Website design and hosting fees also fall into this category.

- Website design and hosting fees: Costs associated with creating, maintaining, and hosting your business website are deductible.

- Local transportation costs: While not "traveling away from home," local business-related transportation can include parking fees, tolls, and public transit fares (e.g., bus, train) for client meetings or business errands.

Key Categories: Professional Development & Other Expenses

Don't overlook these categories that contribute to your growth and operational costs.

- Continuing education and training: If the education maintains or improves skills needed in your current business, it's deductible. This includes courses, seminars, and workshops.

- Professional organization memberships and dues: Fees for professional organizations related to your business are deductible.

- Industry-specific supplies: Beyond general office supplies, this includes unique items essential to your trade (e.g., specialized tools, materials for product creation, photography equipment).

- Postage and shipping: Costs for mailing invoices, products, or marketing materials are deductible.

- Interest on business loans and credit cards: Interest paid on money borrowed specifically for your business is deductible. This includes business credit cards or lines of credit.

- Salaries and benefits paid to employees: If you have employees, their wages, salaries, and benefits (including payroll taxes) are deductible business expenses.

Mastering the Big Two: Home Office and Vehicle Deductions

These two categories often represent the largest deductions for self-employed individuals and can offer significant savings. However, they also receive considerable IRS scrutiny, so accurate and thorough documentation is absolutely critical. We're talking about more than just a quick note; we mean detailed logs, receipts, and calculations.

Putting Your self-employed tax deductions worksheet into Action: The Home Office

The home office deduction is a golden opportunity for many self-employed individuals, but it comes with strict rules. To qualify, you must meet two main criteria:

- Exclusive Use: You must use a specific area of your home solely for business. This means no personal use of that space. For example, a desk in your living room that you also use for personal finances wouldn't qualify unless that desk and surrounding area are exclusively for business.

- Regular Use: You must use the area on a regular basis for your business. Occasional use won't cut it.

- Principal Place of Business: The space must be your principal place of business. This means it's where you conduct your most important business activities, even if you also conduct business outside of your home. For example, a consultant who meets clients at their offices but does all their administrative work, billing, and research from their home office would qualify. There are also exceptions for storage of inventory or product samples if your home is the sole fixed location of your business, and for daycare facilities.

When it comes to calculating the deduction, you have two methods:

| Feature | Simplified Method | Regular Method |

|---|---|---|

| Calculation | $5 per square foot of home used for business | Actual expenses for the business use of your home |

| Maximum Size | Up to 300 square feet | No square footage limit (but limited by actual business use) |

| Maximum Deduction | $1,500 | Can be significantly higher, limited by gross income from the business |

| Expenses Included | Covers indirect expenses (utilities, insurance, etc.) | Direct expenses (e.g., repairs only to office) and indirect expenses (e.g., portion of utilities, rent, mortgage interest, property taxes, homeowner's insurance) |

| Depreciation | No depreciation on the home itself | Allows for depreciation of the business portion of your home |

| Record Keeping | Simpler (just square footage) | More complex (track all home expenses, calculate business percentage) |

| Carryover Unallowed Expenses | No | Yes, unallowed expenses can be carried over to future tax years |

| IRS Form | Calculated directly on Schedule C | Requires Form 8829, Expenses for Business Use of Your Home |

To calculate your business use percentage for the Regular Method, you simply divide the square footage of your dedicated business space by the total square footage of your home. For example, if your home office is 150 sq ft and your home is 1,500 sq ft, your business use percentage is 10% (150/1500). You then apply this percentage to your indirect expenses (rent, utilities, homeowner's insurance, mortgage interest, property taxes). Direct expenses, like painting only your office, are 100% deductible.

Tracking Vehicle Expenses Like a Pro

If you use your car for business, you have another major deduction opportunity. Again, meticulous record-keeping is key. You have two methods:

- Standard Mileage Rate: This is the simpler option. For 2025, the IRS’s standard mileage reimbursement rate for self-employed business owners is 70 cents per mile. You multiply your total annual business mileage by this rate. This rate covers gas, oil, maintenance, and depreciation. You can also deduct parking fees and tolls in addition to the standard mileage rate.

- Actual Expense Method: This involves tracking all your actual car-related expenses, including gas, oil, repairs, insurance, registration fees, and vehicle depreciation. You then multiply the total by your business use percentage (business miles / total miles).

What counts as business mileage? Any driving for business purposes, such as driving to client meetings, business conferences, picking up supplies, or traveling between job sites.

The commuting rule: Driving from your home to your primary place of business (e.g., an office you rent outside your home) is generally considered commuting and is not deductible. However, if your home is your principal place of business, then driving from your home office to clients or other business locations is deductible. You can use mileage tracking apps or keep a detailed log of your odometer readings.

Documentation for vehicle expenses: For either method, you need evidence to support your mileage claims. This includes mileage logs, appointment records, calendars, and even odometer readings from repair invoices. If you opt for the actual expense method, keep all receipts for gas, repairs, and other costs.

From Worksheet to Tax Return: Documentation and Filing

The golden rule of tax deductions is simple: if you deduct it, you must be able to prove it. Without proper documentation, your deductions are just claims, and that's a risky game to play with the IRS. The potential consequences of an IRS audit without proper documentation can range from disallowance of deductions and back taxes owed to penalties and interest.

This is why your self-employed tax deductions worksheet is more than just a list; it's a living document backed by solid proof.

Keeping receipts: For every expense on your worksheet, you need supporting documentation. This includes:

- Receipts: For purchases, meals, travel, supplies.

- Invoices: From vendors, contractors, or service providers.

- Bank and credit card statements: These can serve as proof of payment, especially for smaller or recurring expenses, but often need to be paired with a receipt or invoice for full detail. The IRS has kept up with changing times regarding record-keeping, and credit card statements can be accepted as proof.

- Mileage logs: For vehicle deductions.

- Appointment books or calendars: To substantiate business meetings or travel.

- Canceled checks: For payments made.

Digital record-keeping: Digital copies are just as valid as paper. Consider scanning all your receipts and storing them in a cloud-based system. Many apps and software solutions can help you capture, categorize, and store these digitally, ensuring you have access to them whenever needed.

Filing Form 1099-NEC: As a self-employed individual, you might also be an employer of sorts. If you pay someone (an independent contractor, not an employee) $600 or more in a tax year for business-related services, you must file a Form 1099-NEC. This is a federal requirement. If you operate in California, there might be state-specific filing requirements as well. This doesn't apply if you pay them via credit card or PayPal, as the payment processor handles the reporting.

To help you stay on track and ensure you're capturing everything you can, we've prepared a free self-employed tax deduction checklist. Download a free self-employed tax deduction checklist from EnsaPro

Frequently Asked Questions about Self-Employed Deductions

We hear a lot of questions from self-employed individuals about what they can and can't deduct. Let's tackle some of the most common ones.

Can I deduct my health insurance premiums?

Yes, you generally can deduct health insurance premiums if you're self-employed, but there are specific requirements. You can deduct 100% of the premiums you pay for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents, provided that:

- You are not eligible to participate in an employer-sponsored health plan (including one offered by your spouse's employer).

- Your business has a net profit. If your business's profit is higher than your total premiums, you can write off 100% of your premiums. If your business's net profit is lower than your total premiums, you can only write off the amount equal to your net profit.

This deduction is taken as an adjustment to income on Schedule 1 of Form 1040, not on Schedule C.

How are startup costs for a new business deducted?

Starting a new business involves initial expenses that can be substantial. The IRS allows you to deduct a portion of your startup costs. You can deduct up to $5,000 in business startup costs and $5,000 in organizational costs in the year your business begins. These costs include expenses like LLC filing fees, legal fees, market research, advertising, and training. If your total startup or organizational costs exceed $50,000, the deductible amount is reduced dollar for dollar by the amount over $50,000. Any costs exceeding the initial $5,000 deduction must be amortized (deducted equally) over 180 months (15 years), starting with the month your business begins operation.

Can I deduct the cost of my computer and office furniture?

Absolutely! The cost of equipment like computers, printers, cameras, and office furniture (desks, chairs, filing cabinets) used for your business is generally deductible. You have a few options:

- Section 179 Deduction: This allows you to deduct the full purchase price of qualifying equipment (up to a certain limit, which is over $1 million and adjusted annually for inflation) in the year it's placed in service, rather than depreciating it over several years.

- Bonus Depreciation: This allows for an accelerated deduction in the first year. The bonus depreciation rate for qualified property placed in service during 2025 is 40%, as the 100% rate is being phased out.

- Depreciation: If you don't use Section 179 or bonus depreciation, you can depreciate the cost of the asset over its useful life (typically 5 or 7 years for computers and furniture).

- De Minimis Safe Harbor: For lower-cost items (generally under $2,500 per item if you don't have an applicable financial statement), you can elect to deduct the full cost as an expense in the year of purchase, simplifying record-keeping.

Our experts at EnsaPro can help you determine the best method for your specific purchases to maximize your deduction.

Conclusion: Turn Your Worksheet into Maximum Savings

A well-maintained self-employed tax deductions worksheet is truly your secret weapon. It transforms tax season from a chaotic scramble into an organized process, empowering you to confidently claim every deduction you're entitled to. This commitment to accuracy and thoroughness not only protects you in the event of an audit but also ensures you keep more of your hard-earned money, turning tax season from a chore into an opportunity.

Every receipt, every mileage log, and every categorized expense contributes to a lower tax bill. Don't leave money on the table!

For a personalized approach to ensure you get every deduction you deserve, the experts at EnsaPro, located in Irvine, California, are here to help. We offer a free, no-obligation tax return draft and a thorough, personalized approach to maximize your savings.

Get your free, no-obligation tax return draft from EnsaPro today.