The Refund Report: How to Check Your IRS Status in Minutes

Why Checking Your IRS Refund Status Matters

When you check IRS status for your tax refund, you want answers fast. Here's exactly how to do it:

Quick Answer: How to Check Your IRS Refund Status

- Go to the IRS "Where's My Refund?" tool at IRS.gov/refunds or use the IRS2Go mobile app

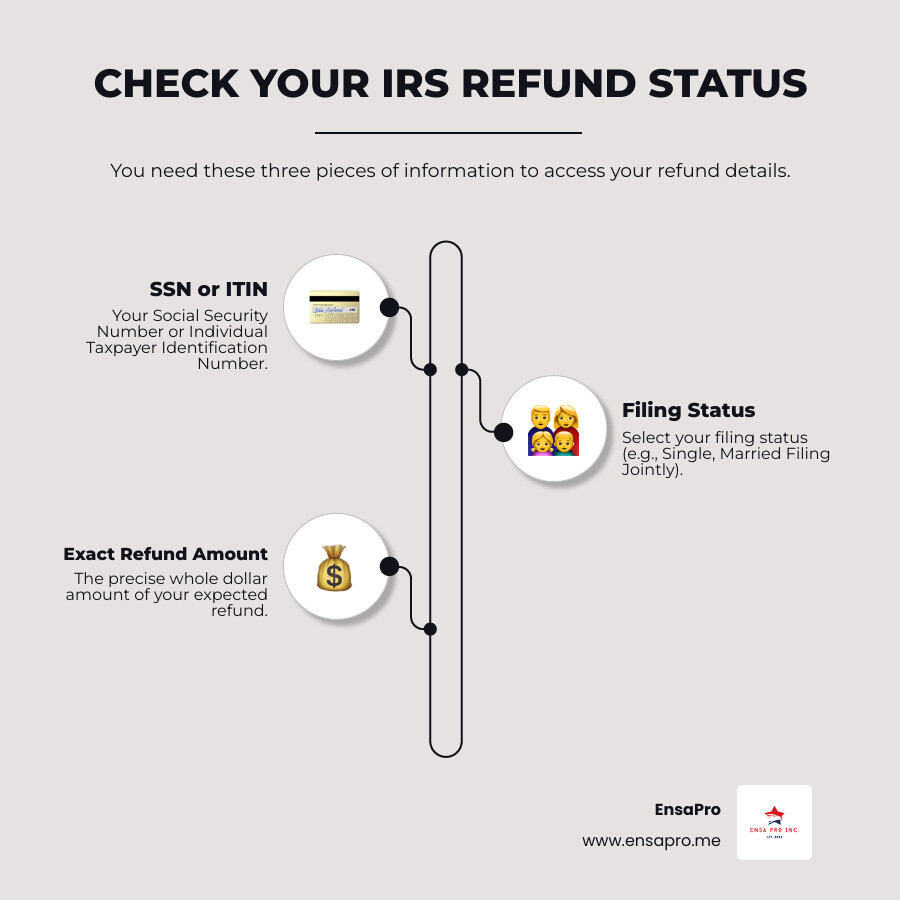

- Enter three pieces of information:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Your filing status (Single, Married Filing Jointly, etc.)

- The exact whole dollar amount of your expected refund

- Check within 24 hours after e-filing or 4 weeks after mailing a paper return

- View your status - the tool shows one of three stages: Return Received, Refund Approved, or Refund Sent

Most taxpayers receive their refund within 21 days of e-filing. The IRS issued more than 9 out of 10 refunds in less than 21 days last tax year.

If you're waiting on your refund, you're not alone. The average refund amount was $3,453 in the 2024 filing season. That's real money that can pay bills, cover unexpected expenses, or go toward savings.

Waiting without knowing what's happening creates unnecessary stress. The good news? The IRS provides free tools that give you real-time updates on your refund status. You don't need to call anyone or wait on hold. You just need the right information and a few minutes.

This guide walks you through every step of checking your IRS status, explains what each status means, and shows you what to do if your refund is delayed or incorrect. We'll also cover amended returns, state refunds, and when you actually need to contact the IRS directly.

The Primary Ways to Check Your IRS Refund Status

Navigating tax refunds can sometimes feel like trying to find a needle in a haystack, especially if you're not sure where to start. Fortunately, the IRS has streamlined the process for taxpayers to check IRS status of their refunds, offering user-friendly tools designed for efficiency and clarity. These official methods are the fastest and most reliable ways to track your money.

Using the IRS Online Refund Status Tool

The cornerstone of refund tracking is the IRS's "Where's My Refund?" online tool. This robust system is specifically designed to give you up-to-date information on your federal income tax refund. It's available 24/7, making it incredibly convenient to check IRS status whenever you need to.

Here’s how it works and what you need:

- Access the Tool: Simply visit the official IRS website and steer to the "Where's My Refund?" page. The most direct link is IRS.gov/refunds.

- Gather Your Information: Before you start, make sure you have three key pieces of information from your tax return readily available:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): This is your unique identifier.

- Your Filing Status: This includes options like Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

- The Exact Whole Dollar Amount of Your Refund: Double-check this number on your filed tax return. Even a cent off can prevent the tool from finding your information.

- Enter and View: Once you enter these details, the tool will display your refund status. It's that simple!

Important Note on Updates: The IRS "Where's My Refund?" tool is updated once a day, usually overnight. This means there's no need to check multiple times throughout the day, as the information won't change. Typically, the tool is unavailable each morning, generally between 4-5 a.m. Eastern time, while these updates are being made. So, if you're an early bird and can't access it, try again a little later.

Using this tool helps us manage expectations and gives us peace of mind, knowing we're getting the same information an IRS representative would see if we called.

How to Check IRS Status Using Mobile Access

In our increasingly mobile world, the IRS understands the need for on-the-go access. That's why they offer the IRS2Go mobile app, providing another convenient way to check IRS status directly from your smartphone or tablet.

The IRS2Go app is essentially a mobile version of the "Where's My Refund?" online tool. It offers the same secure access and provides the same information, making it incredibly convenient for users who prefer to manage their affairs from their mobile devices.

To use the app:

- Download: Search for "IRS2Go" in your device's app store (available for both iOS and Android).

- Open and Enter Information: Once downloaded, open the app and enter your SSN/ITIN, filing status, and exact refund amount, just as you would with the online tool.

- View Status: The app will then display your current refund status.

This mobile option is fantastic for quick checks while you're out and about, offering the same daily updates as the desktop version. It’s another way the IRS makes it easier for us to stay informed without being tied to a computer.

Understanding the Three Refund Statuses

When you check IRS status using either the "Where's My Refund?" tool or the IRS2Go app, you'll see one of three distinct statuses. Understanding what each of these means can help you interpret your refund's journey.

Here are the three stages your refund will go through:

- Return Received: This is the initial status you'll likely see. It means the IRS has successfully received your tax return. For e-filed returns, you can typically see this status within 24 hours of filing. For paper returns, it takes significantly longer—around four weeks—for the IRS to process and acknowledge receipt. This stage confirms your return is in the system and processing has begun.

- Refund Approved: This is the exciting stage! It means the IRS has processed your return, confirmed your refund amount, and authorized the refund to be sent. The tool will usually provide a specific date when your refund is expected to be sent. Once you see "Refund Approved," you can generally breathe a sigh of relief, knowing your money is on its way.

- Refund Sent: This final status indicates that the IRS has dispatched your refund. If you chose direct deposit, this means the funds have been sent to your bank. If you opted for a paper check, it means the check has been mailed. While the IRS has sent the funds, it might still take a few business days for the money to appear in your bank account or for the check to arrive in your mailbox, depending on your bank's processing times and postal delivery.

Knowing these stages helps us track our refund effectively and understand exactly where it is in the IRS's system.

Refund Timelines and Receiving Your Money

One of the most common questions we hear is, "When will I get my money?!" It's a valid question, as tax refunds can represent a significant financial boost. Understanding the typical timelines and the best ways to receive your refund can help us plan our finances more effectively.

Typical IRS Refund Processing Times

While we all wish our refunds would appear instantly, there's a standard process the IRS follows. Generally, the speed at which you receive your refund depends largely on how you filed your return and whether there are any complexities.

- E-Filed Returns: The good news is that most taxpayers who electronically file their returns can expect their refund fairly quickly. The IRS generally issues refunds within 21 days of when you electronically filed your tax return. In fact, last tax year, the IRS issued more than 9 out of 10 refunds in less than 21 days. For current-year returns filed electronically, you can often check IRS status within 24 hours of the IRS acknowledging receipt. For prior-year returns e-filed, it might take 3 or 4 days to show up in the system.

- Paper Returns: If you choose to mail a paper tax return, the processing time is considerably longer. You should typically allow 6 weeks or more for the IRS to process your return and issue a refund. You can usually start checking the status of a paper return about four weeks after you've mailed it.

While these are general guidelines, some refunds may take longer if your return requires additional review, corrections, or if there are specific circumstances, such as claiming certain credits. We'll dig into common reasons for delays shortly.

Choosing Your Refund Method: Direct Deposit vs. Paper Check

When it comes to receiving your refund, you have options, and your choice can significantly impact how quickly you get your money.

Direct Deposit (The Fastest and Safest Option): We highly recommend choosing direct deposit for your refund. It's the quickest, most secure, and most convenient way to receive your money. When you opt for direct deposit, the IRS electronically transfers your refund directly into your bank account. This method eliminates the risk of your check being lost, stolen, or damaged in the mail, and it means you don't have to wait for postal delivery. If you choose direct deposit and your refund is approved, the funds are typically available in your account within a few business days of the "Refund Sent" status.

Did you know you can even split your refund into up to three different financial accounts? This can be a great way to automatically allocate funds to savings, checking, or even an IRA. You'll need to provide the routing and account numbers for each account on your tax return.

- Paper Check: If you don't have a bank account or prefer to receive a physical check, the IRS will mail you a paper check. While this is a viable option, it's generally slower due to postal delivery times and carries a higher risk of loss or theft compared to direct deposit. If you select this method, ensure your mailing address is up-to-date with the IRS.

Choosing direct deposit not only speeds up the process but also provides an added layer of security, giving us peace of mind that our hard-earned money arrives safely and efficiently.

Troubleshooting Common Refund Issues and Delays

Sometimes, despite our best efforts, our tax refund doesn't arrive as expected, or the amount is different from what we calculated. It's natural to feel frustrated when this happens, but understanding the common reasons for these issues and knowing the steps to take can help us resolve them.

Common Reasons Your Tax Refund Might Be Delayed

While the IRS aims to issue most refunds within 21 days for e-filed returns, several factors can cause delays. If you check IRS status and find your refund is taking longer than expected, it could be due to one of the following reasons:

- Errors or Incompleteness on Your Return: The most frequent culprit for delays is an error on your tax return. This could be anything from a simple math mistake to incorrect Social Security numbers, missing information, or an incorrect filing status. Even small discrepancies can flag your return for manual review, slowing down the process.

- Identity Verification: The IRS takes identity theft very seriously. If they suspect your return might be fraudulent or require additional verification to confirm your identity, processing will be delayed. They may send you a letter requesting more information.

- Claiming Certain Credits: If your return includes claims for the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), the IRS is legally required to hold these refunds until mid-February to allow for additional fraud prevention checks. This means even if you filed early, your refund won't be issued before this period. If you file online, choose direct deposit, and have no issues with your return, you can generally expect your refund by March 1.

- Incomplete or Missing Forms/Documents: If the IRS needs additional forms or information to process your return, they will contact you by mail. Responding promptly to these requests is crucial to avoid further delays.

- Bank Processing Limitations: Sometimes, bank processing limitations, especially on weekends or holidays, can slightly delay when the "Refund Sent" status translates to money in your account.

- Amended Returns: As we'll discuss, amended returns have their own, much longer, processing timeline.

If your refund is delayed, the "Where's My Refund?" tool will often provide a reason or indicate if the IRS needs more information. It's always best to check IRS status there first. For more detailed information on refund delays, you can learn more about refund delays.

What to Do If Your Refund is Missing or Incorrect

Finding your refund is less than expected or hasn't arrived at all can be disheartening. Here’s what steps we can take:

- Refund is Less Than Expected: If you check IRS status and find your refund amount is lower than what you anticipated, it's often due to one of these reasons:

- IRS Corrections: The IRS may have corrected mistakes on your return. They will typically send you a notice (like a CP12 notice) explaining the changes. Always read any IRS correspondence carefully.

- Offset for Debts: Your refund may have been used (offset) to pay federal or state tax debts, child support, spousal support, federal agency non-tax debts (like student loans), or even some state debts. If this happens, you will receive a notice from the Bureau of the Fiscal Service (BFS) explaining the offset. For joint returns, if one spouse's refund was applied to the other spouse's debts, you might need to file Form 8379, Injured Spouse Allocation.

- Refund Check is Missing or Destroyed: If you opted for a paper check and it hasn't arrived within 28 days of the "Refund Sent" date, or if it was lost, stolen, or destroyed, you can generally file an online claim for a replacement check. The "Where's My Refund?" tool will provide detailed instructions if this applies to your situation.

- Incorrect Direct Deposit Information: If you entered the wrong account or routing number for direct deposit, immediately call the IRS at 800-829-1040 to try and stop the deposit. If the funds have already been deposited into an incorrect account, you'll need to contact your bank to attempt to recover the funds. If the bank rejects the deposit, the IRS will then mail a paper check to your address on file.

- You Received a Refund You Weren't Entitled To: If you receive a refund that you know you shouldn't have, it's crucial to return it to the IRS. Not doing so can lead to future penalties and interest. The IRS website provides clear instructions on how to return erroneous refunds, which typically involves writing "Void" on the check (if it hasn't been cashed) and mailing it back with a brief explanation.

In all these scenarios, your first step should always be to check IRS status using the online tool or app, and then carefully review any mail you've received from the IRS.

How to Check IRS Status for an Amended Return

Filing an amended tax return (Form 1040-X) is necessary when you need to correct information on a tax return you've already filed. While essential, it's important to understand that the process for amended returns is different and takes significantly longer than original returns.

Unlike regular tax returns, you cannot check IRS status for an amended return using the standard "Where's My Refund?" tool. The IRS has a separate online tool specifically for this purpose: "Where's My Amended Return?".

Here’s what you need to know:

- Separate Tool: To track your amended return, visit the IRS's "Where's My Amended Return?" tool.

- Information Needed: You'll need your Social Security Number (SSN) or ITIN, your date of birth, and your zip code.

- Timeline: Amended returns take considerably longer to process. They can take up to 3 weeks to show up in the IRS system after you've mailed them, and then up to 16 weeks to process fully. This means you should expect to wait several months before seeing an update.

- No Electronic Filing (Generally): Most amended federal tax returns (Form 1040-X) must be mailed, which contributes to the longer processing times.

Given the extended processing period, patience is key when waiting for an amended return. We recommend checking the "Where's My Amended Return?" tool periodically, but not daily, as updates are infrequent.

Beyond Federal: Checking State Refunds and Other Inquiries

While the federal tax refund is often the largest, many of us also file state income tax returns and might be due a refund from our state. It's crucial to remember that federal and state tax systems are separate, and tracking one doesn't track the other.

Tracking Your State Tax Refund

If you're expecting a state tax refund, you'll need to check IRS status for your state refund through your specific state's tax department. Each state has its own system and timelines.

For our clients in Irvine, California, you'll want to check the status of your California state tax refund through the Franchise Tax Board (FTB).

Here’s how to do it for California:

- Visit the FTB Website: Go to the California Franchise Tax Board's website. They have a "Where's My Refund?" tool similar to the IRS.

- Provide Information: You will typically need your Social Security Number (SSN) or ITIN, your mailing address, and the exact refund amount from your California state tax return.

- Check Status: The tool will provide you with the status of your state refund.

- Phone Option: If you prefer, you can also call the FTB customer service line at 800-852-571. They are usually available weekdays from 8 AM to 5 PM.

The information you see on the federal "Where's My Refund?" tool will not reflect your state refund status, and vice-versa. Always go directly to your state's tax agency for state-specific refund inquiries.

When to Contact the IRS Directly

While the online tools are incredibly helpful for us to check IRS status, there are specific situations where contacting the IRS directly becomes necessary. However, it's important to know when to call and when it's better to rely on the online resources to avoid unnecessary wait times.

When NOT to call the IRS:

- For basic refund status updates: If the "Where's My Refund?" tool or IRS2Go app can provide your status, there's no need to call. The information available to IRS phone assistors is the same as what you can see online. Calling won't speed up your refund or provide new information if it's already available online.

- Before the typical processing time: Avoid calling if it's been less than 21 days since you e-filed or less than 6 weeks since you mailed a paper return (or less than 16 weeks for an amended return). The IRS will not have new information for you before these periods.

When it IS appropriate to contact the IRS directly:

- If the "Where's My Refund?" tool instructs you to: Sometimes, the online tool will display a message telling you to contact the IRS directly. This is a clear indicator that your situation requires personal attention.

- If 21 days or more have passed since you e-filed, and the online tool has not updated or provided a refund date.

- If 6 weeks or more have passed since you mailed a paper return, and the online tool has not updated.

- If 16 weeks or more have passed since you mailed an amended return, and the online tool has not updated.

- If your refund was offset, and you have questions after reviewing the BFS notice.

- If you received a notice from the IRS requesting more information, and you need clarification or assistance responding.

- For business tax return refund information: The "Where's My Refund?" tool is only for individual income tax returns (Form 1040). For federal tax returns other than Form 1040 (e.g., business returns), you need to call the IRS toll-free at 800-829-4933 (or 267-941-1000 from outside the U.S.).

When you do need to call, be prepared for potentially long wait times. Have all your tax documents and personal identification information handy to make the call as efficient as possible. The IRS also offers an automated refund hotline at 800-829-1954 for current-year refunds or 866-464-2050 for amended returns if you don't have internet access.

Frequently Asked Questions about Checking Your IRS Status

We know you've got questions, and we're here to provide quick, clear answers to the most common inquiries about how to check IRS status for your refund.

How often is the IRS refund status tool updated?

The IRS "Where's My Refund?" tool is updated once a day, usually overnight. This means that if you check your status in the morning and again in the afternoon, the information will likely be the same. There's no need to check more frequently than once every 24 hours. The systems are updated once every 24 hours.

Can I check my refund status by phone?

Yes, you can check IRS status by phone, but we generally recommend using the online "Where's My Refund?" tool or the IRS2Go app first. The IRS offers an automated refund hotline at 800-829-1954 for current-year refunds. For amended returns, you can call 866-464-2050. However, it's important to understand that the information available to IRS phone assistors is the same as what's available through the online tools. Calling will not speed up your refund or provide different information than you can find yourself online.

What information do I need to check my refund status?

To check IRS status for your refund, you will need three key pieces of information from your tax return:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your filing status (e.g., Single, Married Filing Jointly, Head of Household).

- The exact whole dollar amount of your refund as shown on your tax return.

Make sure these details are accurate and match your filed return precisely to ensure the tool can locate your information.

Conclusion

Navigating the journey of your tax refund doesn't have to be a mystery. By leveraging the official IRS tools like "Where's My Refund?" and the IRS2Go app, we can confidently check IRS status in minutes, staying informed every step of the way. We've learned that e-filing and choosing direct deposit are our best bets for the fastest refunds, and that accuracy on our tax returns is paramount to avoid delays.

While most refunds are issued within 21 days, understanding the reasons for potential delays and knowing how to track amended returns or state refunds (like through California's FTB) empowers us to troubleshoot effectively. The IRS updates its tools daily, usually overnight, so there's no need for constant checking. And if you ever need to call, be prepared with your information and know when direct contact is truly necessary.

At EnsaPro, located in Irvine, California, we understand that tax season can be complex. That's why we offer personalized tax preparation services designed to achieve the best possible outcome for you. We can help ensure your return is accurate, potentially speeding up your refund process, and we're here to assist with any IRS status checks or questions you might have.

Why not take the stress out of tax season? Let us help you steer your taxes with confidence.

Get a free draft of your tax return