Smart Savings: Uncovering Every Tax Deduction

Why Understanding Tax Deductible Expenses Matters

Tax deductible expenses are costs you can subtract from your income to reduce how much you owe to the IRS. Understanding them is the difference between overpaying on your taxes and keeping more of your hard-earned money.

Key Tax Deductions to Know:

- Standard Deduction: A fixed amount based on your filing status ($15,750 single, $31,500 married filing jointly for 2025)

- Medical Expenses: Costs exceeding 7.5% of your adjusted gross income

- Mortgage Interest: Interest paid on qualifying home loans up to $750,000

- Charitable Donations: Gifts to qualified organizations

- Business Expenses: Costs for running your business or self-employment

- State and Local Taxes (SALT): Up to $40,000 for 2025 (with income limits)

- Student Loan Interest: Up to $2,500 in interest payments

- Retirement Contributions: IRA and HSA contributions

Here's something most people don't realize: about 90% of taxpayers now use the standard deduction instead of itemizing. This happened after the Tax Cuts and Jobs Act nearly doubled the standard deduction amounts in 2017.

But that doesn't mean you shouldn't understand what's deductible.

The problem is simple: missing deductions means paying more taxes than you need to. And the tax code doesn't make it easy. There are dozens of categories, specific thresholds, and documentation requirements that can trip you up.

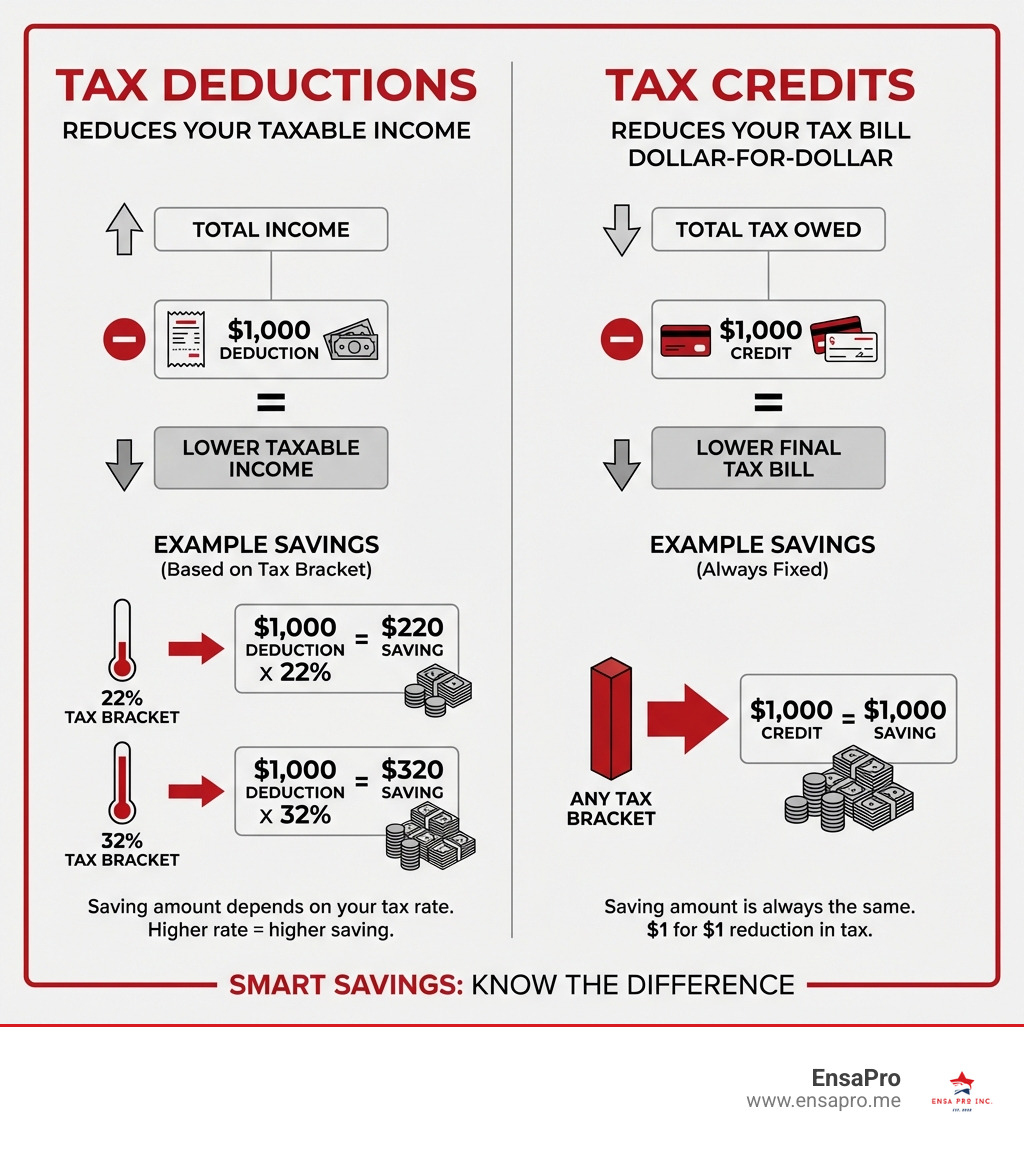

Whether you're a W-2 employee with medical bills, a homeowner with mortgage interest, or a self-employed professional tracking business expenses, knowing what you can deduct is crucial. The difference between a tax deduction and a tax credit matters too—deductions lower your taxable income, while credits reduce your tax bill dollar-for-dollar.

This guide breaks down every major tax deduction available to you. We'll cover individual deductions, business expenses, and help you figure out whether itemizing or taking the standard deduction makes more sense for your situation.

The Foundation: Tax Deductions vs. Tax Credits

Before we dive into specific Tax deductible expenses, understand the fundamental difference between a tax deduction and a tax credit. This distinction is often misunderstood, but it's key to maximizing your tax savings.

A tax deduction is an amount that reduces your taxable income. Think of it like this: if you earn $60,000 and claim $10,000 in deductions, your taxable income drops to $50,000. You're then taxed on that lower amount. The actual dollar value of a deduction depends on your tax bracket. For example, if you're in the 22% tax bracket, a $1,000 deduction saves you $220. Deductions are subtracted from your gross income to arrive at your Adjusted Gross Income (AGI), which is a crucial figure used in many other tax calculations. Some deductions are "above-the-line," meaning they reduce your AGI, while itemized deductions are subtracted after AGI is calculated.

On the other hand, a tax credit is a direct, dollar-for-dollar reduction of your tax bill. If you owe $1,000 in taxes and claim a $1,000 tax credit, your tax bill becomes $0. Credits are generally more valuable than deductions because they reduce your tax liability directly, regardless of your tax bracket.

Tax credits come in two flavors:

- Non-refundable credits can reduce your tax liability to zero, but you won't get any money back if the credit exceeds the tax you owe.

- Refundable credits are the superstars of the tax world! If a refundable credit is more than the tax you owe, the IRS will send you the difference as a refund. This means you could get money back even if you don't owe any tax. The Earned Income Tax Credit is a prime example of a refundable credit.

We can claim credits and deductions when we file our tax return to lower our tax. Understanding both is crucial for a healthy financial outlook.

The Big Decision: Standard vs. Itemized Deductions

Now that we know the difference between credits and deductions, let's tackle the biggest decision many taxpayers face: whether to take the Standard Deduction or itemize their deductions. This choice can significantly impact your overall tax liability.

The Standard Deduction is a fixed dollar amount that taxpayers can subtract from their income. It's a "no-questions-asked" deduction, meaning you don't need to track specific expenses. It simplifies tax filing for millions of Americans.

Itemizing means you're listing out specific eligible expenses one by one. These are reported on Schedule A (Form 1040). If your total itemized deductions exceed the standard deduction amount for your filing status, then itemizing will result in a lower taxable income and potentially a lower tax bill.

The Tax Cuts and Jobs Act (TCJA) of 2017 dramatically changed this landscape. It nearly doubled the standard deduction amounts and eliminated or capped many popular itemized deductions. This shift led to a significant change in taxpayer behavior: in 2018, about 90% of taxpayers used the standard deduction rather than itemize deductions. While itemizing used to be a common strategy for many middle-income homeowners, it's now primarily beneficial for those with very high deductible expenses.

To understand which option is right for you, compare your potential itemized deductions against the standard deduction amount. We'll explore both in more detail. For specific guidance, you can always refer to the official Instructions for Schedule A (Form 1040).

How the Standard Deduction Works

The Standard Deduction is designed to simplify tax filing for most people. The amount you can claim depends primarily on your filing status: Single, Married Filing Separately, Married Filing Jointly, Qualifying Surviving Spouse, or Head of Household.

Here are the standard deduction amounts for recent and upcoming tax years:

- For the 2023 tax year:

- Single taxpayers and Married Filing Separately: $13,850

- Married Couples Filing Jointly: $27,700

- Heads of Households: $20,800

- For the 2024 tax year:

- Single taxpayers and Married Filing Separately: $14,600

- Married Couples Filing Jointly: $29,200

- Heads of Households: $21,900

- For the 2025 tax year:

- Single taxpayers and Married Filing Separately: $15,750

- Married Couples Filing Jointly or Qualifying Surviving Spouse: $31,500

- Heads of Households: $23,625

But wait, there's more! The IRS offers additional standard deduction amounts for individuals who are age 65 or older or blind. For 2025, these additional amounts are $1,600 per person if you're married (filing jointly, separately, or as a qualifying surviving spouse) and $2,000 per person if you're single or head of household. So, if you're single, over 65, and blind, your standard deduction would be $15,750 + $2,000 + $2,000 = $19,750!

While the standard deduction is widely used, some individuals cannot take the standard deduction. This includes non-resident aliens, individuals filing a tax return for a period of less than 12 months, and married individuals filing separately if their spouse itemizes.

Deciding to Itemize Your Deductions

The decision to itemize hinges on one simple question: do your eligible itemized expenses add up to more than your standard deduction? If the answer is yes, then itemizing could save you money. If no, the standard deduction is your best bet for simplicity and maximum savings.

When we itemize, we report these deductions on Schedule A (Form 1040). This is where we list out specific expenses that, when combined, might surpass the standard deduction. Here are some common scenarios where itemizing might make sense:

- High Medical Expenses: If you or your family incurred significant, unreimbursed medical and dental expenses that exceed 7.5% of your Adjusted Gross Income (AGI), you might benefit from itemizing. We'll dig deeper into this below.

- Large Charitable Donations: Generosity can pay off at tax time! If you made substantial cash or non-cash contributions to qualified charities throughout the year, these amounts could push you over the standard deduction threshold.

- Significant Mortgage Interest: Homeowners often find themselves itemizing due to the interest paid on their home mortgage. This can be a substantial deduction, especially in the early years of a mortgage.

- High State and Local Taxes (SALT): If you paid a considerable amount in state income taxes (or sales taxes, if you choose that option), and property taxes, these can contribute to your itemized total. However, remember the federal cap on the SALT deduction, which we'll discuss shortly.

It's important to keep meticulous records of all potential itemized deductions throughout the year. Without proper documentation, the IRS won't let you claim them, and that's a tax headache we all want to avoid!

Common Tax Deductible Expenses for Individuals

Even if you take the standard deduction, some Tax deductible expenses can still be claimed. These are often referred to as "above-the-line" deductions because they reduce your Adjusted Gross Income (AGI), which is beneficial because AGI is used to calculate eligibility for many other tax benefits. Other deductions are itemized and require you to forgo the standard deduction. Regardless of which path you take, good record keeping is your best friend.

Healthcare and Medical Expenses

Healthcare costs can be a significant burden, and the IRS offers some relief through deductions, though with a high bar. You can deduct the amount of qualified medical and dental expenses that exceeds 7.5% of your Adjusted Gross Income (AGI). This means if your AGI is $100,000, you can only deduct the expenses over $7,500. It's a deduction many hope they don't have to take, as it usually implies a serious health situation.

Deductible medical costs include premiums for medical insurance (if not paid pre-tax), doctor visits, hospital stays, prescription medicines, necessary medical equipment (like crutches or wheelchairs), certain long-term care services, and even travel expenses for medical care (like 21 cents per mile for 2025).

A fantastic way to save on healthcare expenses is through a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are also tax-free. For 2025, the HSA contribution limits are $4,300 for self-only coverage under a High Deductible Health Plan (HDHP) and $8,550 for family coverage under an HDHP. An additional $1,000 catch-up contribution is allowed for those aged 55 or older.

If you're self-employed, you might be able to deduct the health insurance premiums you pay for yourself, your spouse, and your dependents. This is an "above-the-line" deduction, meaning it reduces your AGI.

Education and Retirement Savings

Investing in your future, whether through education or retirement, often comes with tax benefits.

The student loan interest deduction allows you to deduct up to $2,500 of interest paid on qualified student loans each year. This is an "above-the-line" deduction, reducing your AGI, and it can be claimed even if you don't itemize.

Saving for retirement is another smart move with tax advantages. Contributions to a traditional Individual Retirement Arrangement (IRA) are often tax-deductible. For 2025, the maximum IRA deduction is $7,000 for most people, with an additional $1,000 catch-up contribution for those aged 50 or older. This deduction is generally "above-the-line." If you contribute to a 401(k) through your employer, your contributions are typically made pre-tax, effectively reducing your taxable income.

For those dedicated K-12 educators in Irvine, the educator expense deduction allows you to deduct up to $300 (for 2025) for unreimbursed classroom supplies and professional development courses. This is also an "above-the-line" deduction.

Homeowner and Property-Related Deductions

Homeownership comes with its own set of Tax deductible expenses, which can be significant for many Californians.

The home mortgage interest deduction is a big one. You can deduct the interest paid on a mortgage used to buy, build, or substantially improve your main home or a second home. There are limits, however: for debt taken out after December 15, 2017, you can deduct interest on up to $750,000 of qualified mortgage debt ($375,000 if married filing separately). For debt taken out on or before that date, the limit is $1,000,000 ($500,000 if married filing separately).

State and Local Taxes (SALT) paid, including income taxes, general sales taxes (you choose one or the other, not both), and real estate taxes, are generally deductible. However, this deduction is capped. For 2024, the SALT deduction is capped at $10,000 ($5,000 if Married Filing Separately). For 2025, the cap is increased to $40,000 ($20,000 for married filing separately), though it can be reduced if your Modified Adjusted Gross Income is over $500,000 ($250,000 for married filing separately). Given property values and state income tax rates in California, this cap can still limit the deduction for many homeowners.

Other Notable Individual Deductions

Beyond the big categories, other specific expenses can qualify as deductions if you itemize:

- Charitable Contributions: Your generosity to qualified nonprofit organizations can be a deduction. You'll need written acknowledgment for contributions of $250 or more. If you volunteer, out-of-pocket expenses, like mileage (14 cents per mile for 2025) for driving to and from the volunteer site, can also be deducted.

- Gambling Losses: If you're a lucky (or unlucky) gambler, you can deduct gambling losses, but only up to the amount of your gambling winnings reported as taxable income. So, if you win $5,000 but lose $7,000, you can only deduct $5,000 of your losses.

- Casualty and Theft Losses: Unfortunately, these losses are now deductible only if they result from a federally declared disaster. There's also a per-loss limit of $100 and a 10% AGI threshold for these deductions.

Key Business & Self-Employed Tax Deductible Expenses

For business owners, freelancers, and independent contractors, understanding Tax deductible expenses is paramount. These deductions can significantly reduce your business's taxable income, directly impacting your bottom line. The general rule from the IRS is that an expense must be "ordinary and necessary" to be deductible. Ordinary means it's common and accepted in your industry; necessary means it's helpful and appropriate for your business. It doesn't have to be indispensable.

A critical distinction for self-employed individuals is separating business expenses from personal expenses. Commingling funds or failing to document the business purpose of an expense is a common mistake that can lead to issues with the IRS.

Startup, Office, and Operational Costs

Getting a business off the ground or simply running its daily operations involves numerous deductible costs:

- Home Office Deduction: If you use a part of your home exclusively and regularly for business, you might qualify for this deduction. You can choose between the simplified method ($5 per square foot, up to 300 square feet) or calculating actual expenses, which requires more detailed record-keeping but can yield a larger deduction. This is particularly relevant for many remote workers and small business owners in California.

- Office Supplies: Pens, paper, printer ink, and other consumables used in your business are fully deductible.

- Business Insurance: Premiums paid for business liability, professional malpractice, or even workers' compensation insurance are deductible as ordinary and necessary expenses.

- Utilities and Rent: If you have a dedicated office space, the rent and utilities (electricity, internet, phone) are fully deductible. If you work from a home office, a portion of these might be included in your home office deduction.

- Business Gifts: Spreading goodwill with clients or referral sources? Business gifts are deductible up to $25 per recipient per year. Keep track of these! Gifts to employees, however, don't face this limit but may be taxable compensation to the employee. For more details, refer to IRS regulations on Business gifts are deductible up to$25per recipient per year, including holiday gifts to clients or referral sources. Gifts to employees don't face this limit but may be taxable compensation..

Vehicle, Travel, and Meal Expenses

Business on the go often means deductible expenses:

- Vehicle Expenses: For business use of your car, you have two options:

- Standard Mileage Rate: This is the simpler method. For 2025, the standard mileage rate is 70 cents per mile. You'll need to keep a mileage log.

- Actual Expense Method: This involves tracking all vehicle-related costs, including gas, oil, repairs, insurance, registration fees, and depreciation. This method often requires more detailed record-keeping but can sometimes result in a larger deduction. Commuting from home to your primary workplace is generally not deductible. However, travel between different business locations or to client sites is.

- Business Travel Costs: When you travel away from your "tax home" (typically your main place of business) for business purposes, expenses like airfare, lodging, and transportation at your destination are deductible.

- Business Meals: Generally, business meals are 50% deductible when you're discussing business with clients, employees, or partners. The meal must not be lavish or extravagant, and you must be present. Entertainment expenses, however, were largely eliminated as a deduction by the TCJA.

Employee and Contractor Payments

If your business has a team, the costs associated with them are significant deductions:

- Salaries and Wages: The compensation you pay to employees is a fully deductible business expense, provided it's reasonable.

- Employee Benefits: Costs for employee benefits like health insurance premiums, retirement plan contributions (e.g., 401(k) matches), and educational assistance are also deductible.

- Payroll Taxes: The employer portion of Social Security, Medicare, and unemployment taxes paid on behalf of your employees is deductible.

- Payments to Independent Contractors: If you pay independent contractors or freelancers, these payments are deductible. Just remember that you'll need proper tax documentation from contractors and must report payments exceeding $600 annually to the IRS (on Form 1099-NEC).

Frequently Asked Questions about Tax Deductions

We understand that navigating Tax deductible expenses can bring up many questions. Here, we address some of the most common ones we hear.

What is the difference between a tax deduction and a tax credit?

This is a crucial distinction! A tax deduction reduces your taxable income. For example, if you have an income of $70,000 and a $5,000 deduction, you'll be taxed on $65,000. The actual amount you save depends on your tax bracket. A tax credit, on the other hand, directly reduces the amount of tax you owe, dollar-for-dollar. If you owe $2,000 in taxes and have a $500 tax credit, your tax bill becomes $1,500. Tax credits are generally more valuable because their impact isn't diluted by your tax bracket. Some credits can even be refundable, meaning they can put money back in your pocket even if you owe no tax!

What documentation do I need to claim tax deductions?

Documentation is king when it comes to Tax deductible expenses! The IRS requires taxpayers to keep adequate records to substantiate their deductions. This typically includes:

- Receipts: For nearly all expenses, keep original receipts, invoices, or canceled checks.

- Bank and Credit Card Statements: These can help prove payment, but usually aren't enough on their own to prove the nature of the expense.

- Mileage Logs: For vehicle expenses, detailed logs showing date, destination, business purpose, and mileage are essential.

- Written Acknowledgments: For charitable contributions of $250 or more, you must have a written acknowledgment from the charity.

- Forms: For specific deductions like student loan interest, you'll receive forms like Form 1098-E. For mortgage interest, you'll get Form 1098.

- Photos: For large non-cash charitable donations, photos can help document the condition of the donated items.

It's a good practice to keep tax records for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. For business expenses, even longer is often recommended.

Should I take the standard deduction or itemize?

This is the million-dollar question for many taxpayers! The decision boils down to which option results in a lower tax bill for you.

You should itemize your deductions if your total eligible itemized expenses (like medical expenses, state and local taxes, mortgage interest, and charitable contributions) are greater than the standard deduction amount for your filing status. For instance, if you're single and your itemized deductions add up to $16,000, while the 2025 standard deduction for singles is $15,750, then itemizing would be more beneficial.

You should take the standard deduction if your total itemized deductions are less than the standard deduction amount. As we mentioned, about 90% of taxpayers now take the standard deduction, largely due to the increased amounts from the Tax Cuts and Jobs Act.

The best way to figure this out is to gather all your potential deductible expenses and calculate your total itemized deductions. Then, compare that total to the standard deduction for your filing status. Many tax software programs and tax professionals can quickly perform this comparison for you. Don't leave money on the table by guessing!

Conclusion

Understanding and strategically utilizing Tax deductible expenses is a cornerstone of smart financial planning. It's not just about compliance; it's about making sure you're not paying more than your fair share in taxes. Whether you're benefiting from the simplicity of the standard deduction or carefully tracking expenses to itemize, every dollar you legitimately deduct is a dollar that stays in your pocket.

We've covered a wide array of deductions, from healthcare and education to homeownership and business operations. The key takeaways are clear:

- Know the difference between deductions and credits.

- Compare the standard deduction to your potential itemized deductions each year.

- Document everything! Good record-keeping is non-negotiable.

The tax landscape is constantly evolving, with new laws and updated limits, like those we've seen for 2025. Staying informed and proactive with your tax planning can lead to significant savings and peace of mind.

If the thought of sifting through receipts, understanding complex IRS rules, and ensuring you've captured every possible deduction feels overwhelming, you don't have to do it alone. Our team at EnsaPro specializes in personalized tax preparation services. We're here to help you steer the complexities, ensure accuracy, and work towards the best possible outcome for your tax situation.

Ready to uncover every potential deduction and maximize your refund? Take the first step towards smarter tax savings today.

Get your free tax return draft