Tax Season Savior: A Guide to Finding Expert Tax Help Locally

Why Finding the Right Tax Advisor Matters

Tax advisors in my area can transform your tax season from stressful to straightforward, but only if you know how to find the right professional for your needs.

Quick Answer: How to Find Tax Advisors in Your Area

- Use the IRS Directory - Search the IRS Directory of Federal Tax Return Preparers to find credentialed professionals near you.

- Verify Credentials - Look for CPAs, Enrolled Agents (EAs), or tax attorneys with valid PTINs.

- Check Reviews - Read testimonials and ratings from local clients.

- Ask for Referrals - Get recommendations from friends, family, or your financial institution.

- Interview Multiple Advisors - Ask about their experience, fees, and specializations before committing.

The stakes are real. According to recent data, CPAs charge an average of $319 for a basic tax return, with costs rising to $521 for returns that include business income. These fees reflect the complexity of tax preparation and the value of professional expertise.

But how do you find a qualified tax advisor who will give you personalized attention rather than rushing through your return? Someone who will not miss deductions that could save you hundreds or thousands of dollars?

This guide walks you through the essentials - from understanding what different tax professionals do, to verifying their credentials, to asking the right questions before you hire. Whether you are dealing with a simple W-2 or complex business income, you will learn how to find expert help that fits your specific situation.

Understanding the Role of a Tax Advisor

A tax advisor is more than just a person who fills out forms; they are a financial guide who can help you steer the often-complex world of taxation. Their primary goal is to ensure you meet your tax obligations while optimizing your financial position. At EnsaPro, we believe in a thorough, personalized approach to help you achieve the best possible outcome.

Here is a closer look at the core services a skilled tax advisor, like those at EnsaPro in Irvine, California, can offer:

- Tax Preparation: Accurate completion and filing of your annual tax returns. This includes handling various income types such as W-2s, 1099s, K-1 distributions, and rental property income. For small businesses, it covers filing for sole proprietors, S-corps, C-corps, and partnerships.

- Tax Planning: Proactive, year-round planning to reduce current and future tax liabilities, offering customized tax advice throughout the year and helping you make informed financial decisions.

- IRS Representation: If you face an audit, inquiries, or other issues with the IRS or state tax authorities, a qualified tax advisor can represent you and communicate with tax authorities on your behalf.

- Audit Support: Advisors can help you gather necessary documents, understand the audit process, and represent your interests.

- Estate and Wealth Planning: For individuals and families, tax advisors can integrate tax strategy into your broader estate and wealth plan to help minimize taxes on inheritances and transfers of wealth.

- Business Tax Services: For small business owners in Irvine, a tax advisor can be a game-changer. Services can include business tax filing, proactive strategy and tax planning, bookkeeping, and assistance with choosing the right entity type (LLC, C Corp, Sole Proprietor, S Corp) for start-ups.

- Identifying Deductions and Credits: Tax laws are constantly changing, and a professional can help ensure you claim all eligible deductions and credits.

- Financial Clarity: A tax advisor aims to provide you with financial clarity, helping you understand your tax situation and overall financial health.

Types of Tax Advisors and Their Qualifications

The term "tax advisor" is broad, encompassing various professionals with different levels of expertise, education, and authorization. Understanding these distinctions is key to finding the right fit for your needs in Irvine, California.

- Certified Public Accountants (CPAs): State-licensed accounting professionals. To become a CPA, individuals must meet education requirements (typically 150 semester hours), pass the four-part Uniform CPA Examination, and fulfill specific work experience requirements. CPAs possess "unlimited representation rights" before the IRS and can represent taxpayers on any tax issue. They can also provide services beyond tax preparation, including financial planning and business consulting. You can verify a CPA's license and standing with state boards using the CPA Verify tool.

- Enrolled Agents (EAs): Tax professionals authorized by the U.S. Department of the Treasury to represent taxpayers before the IRS. They achieve this status by passing the three-part Special Enrollment Examination covering federal tax law, or by having qualifying IRS experience. EAs also have unlimited representation rights and are required to complete continuing education to maintain their credential. You can find more information about them on the Enrolled Agent Information page.

- Tax Attorneys: Licensed law professionals who specialize in taxation. They hold a law degree (J.D.) and often an advanced degree in tax law (LL.M. in Taxation). Like CPAs and EAs, tax attorneys have unlimited representation rights before the IRS and can represent clients in tax court. They are particularly valuable for complex legal tax matters, tax litigation, or intricate estate planning.

- Other Tax Preparers (with PTIN): Any individual who prepares tax returns for compensation must have an IRS Preparer Tax Identification Number (PTIN). This is a basic requirement but does not by itself signify professional credentials or specific expertise. Those who participate in the IRS's Annual Filing Season Program (AFSP) complete continuing education annually and have limited representation rights, meaning they can only represent clients whose returns they prepared and signed, and only before certain IRS employees.

Here is a simplified comparison of common services and who they are best for:

Tax Preparation

- Typical services: Individual tax preparation (including multi-state and non-resident), partnership and corporation returns, and estate and gift tax preparation.

- Representation rights: Limited (AFSP participants) or unlimited (CPAs, EAs, Tax Attorneys).

- Best for: Individuals and businesses with basic to complex tax situations.

Tax Planning

- Typical services: Proactive strategy and tax planning, year-round customized tax advice, tax strategy for investments and estate plans, and business accounting and consulting.

- Representation rights: Limited (AFSP participants) or unlimited (CPAs, EAs, Tax Attorneys).

- Best for: Individuals and businesses seeking to optimize their financial future and minimize tax liabilities.

IRS/State Representation

- Typical services: Representation in IRS audits, federal and state representation, and second opinion services.

- Representation rights: Unlimited (CPAs, EAs, Tax Attorneys); limited (AFSP participants).

- Best for: Taxpayers facing audits, inquiries, or needing assistance with tax collection issues or appeals.

Financial Advisory and Support

- Typical services: Financial clarity and overall financial health reviews, bookkeeping services, and accounting software support.

- Representation rights: Not focused on representation.

- Best for: Individuals and businesses looking for broader financial guidance, not just tax preparation.

When Do You Need to Hire a Tax Professional?

Deciding when to seek professional tax help can save you money, time, and a lot of headaches. While tax software might seem appealing for its low cost, it often falls short once your financial life becomes even slightly complex.

Here are some clear indicators that it is time to consider hiring a qualified tax advisor in my area, particularly in Irvine, California:

- Complex Tax Situations: If you have more than just a simple W-2, your taxes are likely becoming complex. This includes having various income sources like 1099s (freelance or contract work), K-1 distributions from partnerships, or rental property income. Taxpayers with multiple activities, extensive stock transactions, or several investment accounts benefit from expert guidance.

- Major Life Events: Significant life changes often have substantial tax implications. Getting married or divorced, buying or selling a home, welcoming a child, experiencing a death in the family, or retiring can alter your tax situation. A tax advisor can help you steer these changes to ensure you are taking advantage of new deductions or credits and avoiding potential pitfalls.

- Small Business Ownership: Running a small business, whether as a sole proprietor, LLC, S-corp, or C-corp, adds layers of complexity. You will deal with business expenses, depreciation, payroll, and possibly sales tax. A tax advisor can help with entity choice for start-ups, proactive tax planning, and ensuring you are compliant with federal and state business tax laws.

- Investment Income: If you have capital gains or losses from stocks, bonds, or other investments, or if you are dealing with cryptocurrency, a tax professional can help optimize your strategy and ensure accurate reporting.

- Rental Properties: Owning rental property involves specific deductions, depreciation rules, and income reporting that can be tricky to manage on your own.

- Confusing Tax Software: If you find yourself spending hours trying to understand tax software, or if you are unsure whether you are claiming all eligible deductions, a professional can offer clarity and peace of mind.

- Year-Round Planning: Many taxpayers need more than once-a-year filing. A partner who can provide ongoing, customized advice throughout the year helps you make smart financial decisions that impact your tax liability.

- Audit Concerns: If you have received a letter from the IRS or are worried about an audit, a tax professional with representation rights (like a CPA or Enrolled Agent) can be your advocate.

Here are 5 signs it is time to hire an EnsaPro tax advisor:

- You own a small business or have significant self-employment income.

- You have experienced a major life event like buying a house, getting married, or having a child.

- You have complex investments, such as stocks, rental properties, or cryptocurrency.

- You feel overwhelmed or unsure about accurately preparing your own taxes.

- You want proactive tax planning advice, not just year-end filing.

How to Find Qualified Tax Advisors in My Area

Searching for a qualified tax advisor in my area can feel like a daunting task, especially when you are looking for someone trustworthy and competent in Irvine, California. You want to work with someone who genuinely cares about your financial well-being and can help you achieve a solid outcome.

Step 1: Using EnsaPro’s Online Resources to Find Tax Advisors in My Area

When you are ready to find a tax advisor, start by leveraging reliable resources that can help you identify qualified professionals in Irvine, California.

- EnsaPro’s Trusted Directory: EnsaPro provides personalized tax services from a team of professionals located in Irvine, California, offering a free, no-obligation tax return draft and thorough, personalized service.

- IRS Directory of Federal Tax Return Preparers: The IRS maintains a directory to help you find preparers who currently hold professional credentials recognized by the IRS, or who hold an Annual Filing Season Program Record of Completion. You can use this directory to search for professionals in your area. Access it at the IRS Directory of Federal Tax Return Preparers.

- State Licensing Boards: For CPAs, verify licensing and standing through state boards. The National Association of State Boards of Accountancy’s CPA Verify tool is a useful resource.

- Professional Organizations: Many tax preparers belong to professional organizations. For those in California, the California Society of Tax Consultants offers a directory to help you find a tax preparer or consultant.

- Referrals: Ask friends, family, or business colleagues in Irvine for recommendations. Your financial institution might also have suggestions.

Step 2: Verifying Credentials and Qualifications

Once you have a shortlist of potential tax advisors in my area, the next step is to verify their credentials and qualifications.

- Preparer Tax Identification Number (PTIN): Any individual who prepares tax returns for compensation is required by IRS law to have a PTIN. Always ask for it. You can verify someone’s PTIN using the IRS’ tax preparer directory.

- License Verification: For CPAs, verify their license with the California Board of Accountancy, starting with the CPA Verify tool. For Enrolled Agents, their status can be confirmed through the IRS website.

- Professional Status: Beyond the PTIN, look for credentials like CPA, Enrolled Agent, or Tax Attorney. These indicate a higher level of education, examination, and ethical standards, along with "unlimited representation rights" before the IRS.

- Professional Liability Insurance: Ask if the tax advisor carries professional liability insurance. While not always mandatory, it can protect both the advisor and their clients in case of errors or disputes.

Step 3: Key Questions to Ask a Potential Advisor

Before you commit to a tax advisor, a brief interview helps you gauge their expertise, understand their process, and determine if they are a good fit. Here are critical questions to ask:

- What are your credentials and how long have you been practicing? (e.g., CPA, EA, Tax Attorney, AFSP participant).

- Do you have experience with my specific tax situation? (e.g., small business, rental properties, investments, multi-state income).

- How do you structure your fees? (e.g., flat fee, hourly, per form). Be wary of anyone who charges based on the size of your refund.

- What is your process for preparing my tax return? (e.g., how you collect documents, typical timeline). At EnsaPro, there is a free, no-obligation tax return draft so you can review work before committing.

- How do you communicate with clients, and what is your availability outside of tax season? (e.g., email, phone, in-person, specific hours).

- Can you represent me if I am audited by the IRS or the Franchise Tax Board? Confirm their representation rights.

- Do you e-file returns? The IRS requires preparers of more than 11 returns to e-file, and it is generally faster and more secure.

- How do you ensure the security and confidentiality of my personal financial information?

- Do you offer tax planning advice, or just tax preparation?

- Can you provide references or testimonials from current clients?

The Cost of Professional Tax Help

The cost of hiring a professional tax advisor in my area can vary based on several factors, but it is often an investment that pays off through maximized refunds, identified deductions, and peace of mind.

According to national statistics:

- The average cost of income tax preparation often ranges from about $150 to $190.

- Individual tax preparation services average around $242, with prices typically ranging from roughly $137 to $454.

- CPAs planned to charge an average of about $319 for a basic, non-itemized 1040 in 2024.

- For itemized returns, CPAs planned to charge an average fee of about $377.

- Returns featuring Schedule C for business income were anticipated to average around $521.

- The average hourly rate nationally for a tax prep professional can range between about $150 and $450.

These figures illustrate that the complexity of your tax situation is the primary driver of cost. For example:

- A simple W-2 only return might be as low as about $50.

- A W-2 with additional forms like 1099-INT and 1098-E could be around $150.

- If you have several tax forms and one or two additional considerations such as a rental property, investment transactions, K-1 income, 1099-MISC, or a simple small business, you might expect to pay around $225.

- For those with multiple activities (rentals, K-1 income, small business, etc.) and several stock transactions, costs can reach $395 or more.

At EnsaPro in Irvine, California, transparency in pricing is important. The team assesses your specific needs and offers a free, no-obligation tax return draft, which allows you to see the work and understand the likely costs before you commit.

Fee Structures: Tax advisors typically use a few different fee structures:

- Flat Fee: A set price for a specific service, often used for standard individual returns.

- Per Form Pricing: Charges based on the number and type of tax forms required.

- Hourly Rate: Common for more complex situations, extensive tax planning, or audit representation.

When discussing fees, always confirm what is included in the price. Ask whether it covers state and federal returns and whether brief follow-up questions are included.

Frequently Asked Questions about Local Tax Advisors

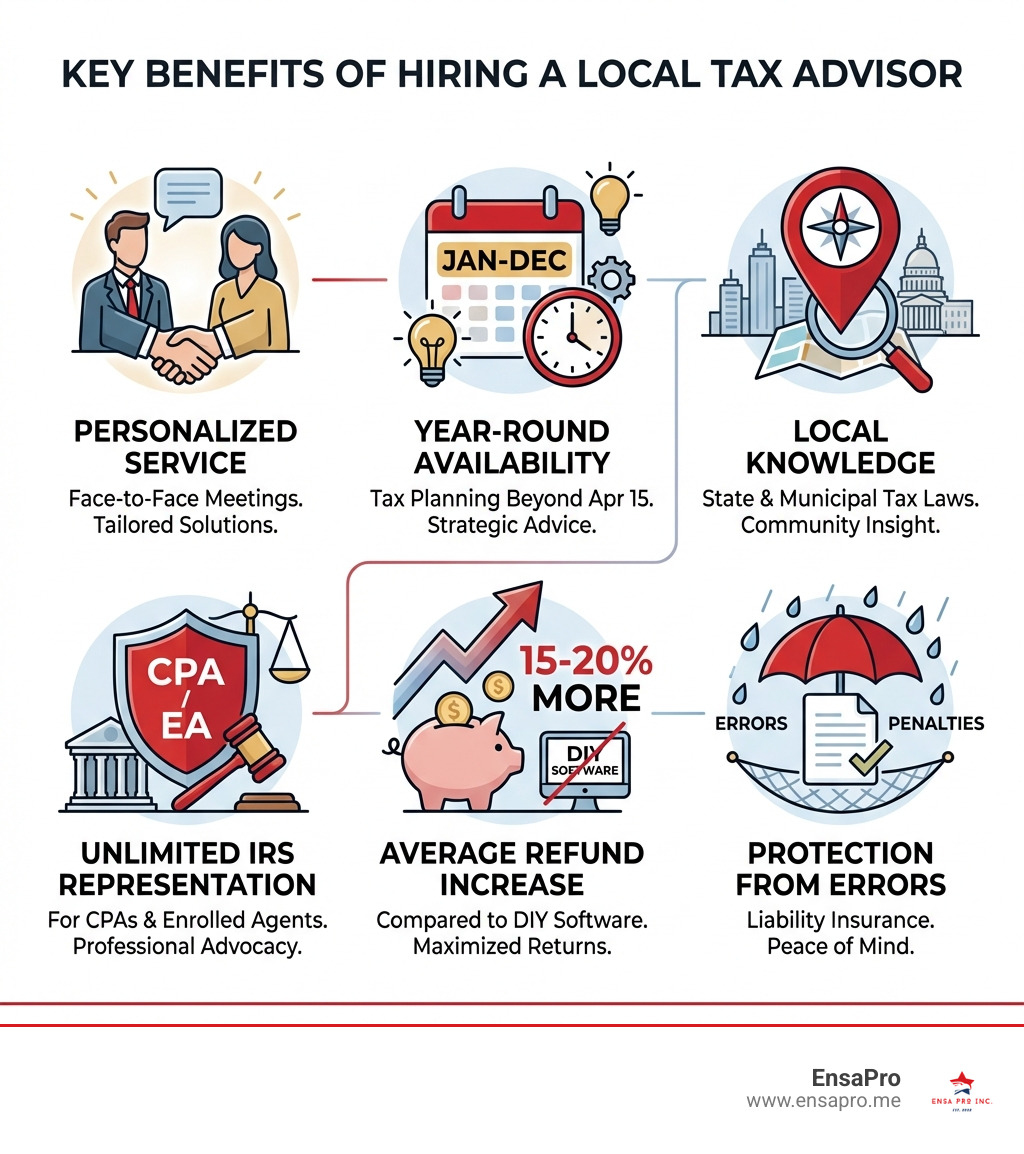

What are the benefits of using a local EnsaPro tax advisor?

Choosing a local EnsaPro tax advisor in my area offers several distinct advantages, especially when you are in Irvine, California:

- Personalized Service: A local advisor offers direct, one-on-one interaction. They can sit down with you, understand your financial situation, and tailor advice that fits your specific goals.

- Year-Round Availability: Financial decisions made throughout the year have tax implications. A local advisor is available for proactive tax planning, not just during filing season.

- Community Knowledge: A local advisor understands the economic landscape and tax considerations relevant to Irvine, California. They are familiar with California's tax environment, helping you stay compliant at all levels.

- Building a Long-Term Relationship: A consistent relationship means your advisor gains a deeper understanding of your financial history and future goals.

- Peace of Mind: Knowing a qualified professional is handling your taxes reduces stress and the risk of errors. EnsaPro’s free draft and IRS status checks are part of this commitment.

What should I do if I have a complaint about one of the tax advisors in my area?

While most tax advisors are reputable professionals, instances of misconduct or fraud can occur. The IRS is committed to investigating those who act improperly, and it is important to know your options if you have a complaint.

If you believe you have been financially impacted by a tax preparer's misconduct or improper practices, here is what you can do:

- Gather Documentation: Collect all relevant paperwork, including your tax returns, correspondence with the preparer, receipts, and any evidence of financial harm.

- Contact the IRS: The IRS provides tips on avoiding unscrupulous tax preparers and offers avenues for reporting misconduct. You can refer to the IRS website for guidance on choosing a tax preparer wisely and reporting issues.

- Contact State Licensing Boards: If your complaint is against a CPA, you can contact the California Board of Accountancy. For Enrolled Agents, the IRS Office of Professional Responsibility handles complaints.

- Consider Legal Action: In severe cases of fraud or significant financial loss, you might need to consult with a legal professional.

At EnsaPro, client satisfaction and ethical practice are essential. If you have any concerns regarding the services or a specific advisor, reach out to EnsaPro’s client support team directly for assistance.

What documents do I need to bring to my tax advisor?

Preparing for your meeting with a tax advisor in my area means gathering all necessary documents to help ensure an accurate and comprehensive tax return. Here is a concise checklist of what to bring to your EnsaPro tax advisor:

Personal Information:

- Social Security numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) for you, your spouse, and dependents.

- Dates of birth for yourself, spouse, and dependents.

- Current mailing address.

- Bank account information for direct deposit of refunds or direct debit of payments.

Income Documents:

- W-2 forms from all employers.

- 1099 forms (such as 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, 1099-B, 1099-R, 1099-G, 1099-K).

- K-1 forms from partnerships, S corporations, and trusts.

- Records of rental property income and any other income such as alimony received, gambling winnings, or royalty income.

Deductions and Credits Documents:

- Education expenses (1098-T and receipts for books and supplies).

- Medical expense records.

- Homeownership records such as Form 1098 (mortgage interest), property tax statements, and home sale documents.

- Child care expense details (provider information and amounts paid).

- Charitable contribution receipts.

- Retirement contribution records.

- Student loan interest (1098-E).

- Business expense records for self-employed individuals (income and expense details, mileage logs, home office information).

Prior Year Information:

- Previous year's tax return (federal and state).

Health Insurance Information:

- Form 1095-A, 1095-B, or 1095-C, if applicable.

Estimated Tax Payments:

- Records of any estimated tax payments made during the year.

If you have an Individual Taxpayer Identification Number (ITIN), gather all relevant documents. ITIN filers may be eligible for free help filing their taxes and can potentially claim valuable tax credits, such as the California Earned Income Tax Credit (CalEITC).

It is always better to bring more documentation than you think you need. Your EnsaPro tax advisor will help you sort through everything to ensure nothing important is missed.

Conclusion

Navigating the complexities of tax season does not have to be a solo, stress-inducing journey. By understanding the various types of tax advisors, knowing when to seek their expertise, and asking the right questions, you can find a qualified professional who will handle your tax preparation and provide valuable planning support.

For those in Irvine, California, finding a local tax advisor in my area means securing a partner who understands your financial landscape and is committed to your success. At EnsaPro, the focus is on personalized tax preparation services, including a free, no-obligation tax return draft and thorough IRS status checks. The goal is to help you achieve a strong outcome while providing financial clarity and peace of mind.

Do not let tax season catch you unprepared. Take a proactive step toward securing your financial future.

Explore personalized tax services