Draft Tax Forms: Your Sneak Peek at Next Year's Taxes

Why Understanding Draft Tax Forms Matters for Your Financial Future

A draft income tax return is an early release version of tax forms (like Form 1040) that the IRS publishes before the official tax season begins. These drafts give taxpayers and tax professionals a preview of upcoming changes, new requirements, and updated deduction amounts for the next tax year.

Key Facts About Draft Tax Forms:

- Purpose: Inform taxpayers of potential changes and allow for early tax planning

- Status: Not for filing - they're informational only and subject to change

- Availability: Found at IRS.gov/DraftForms and state tax authority websites

- Changes: May include new questions (like digital asset reporting), updated deduction amounts, or revised credit calculations

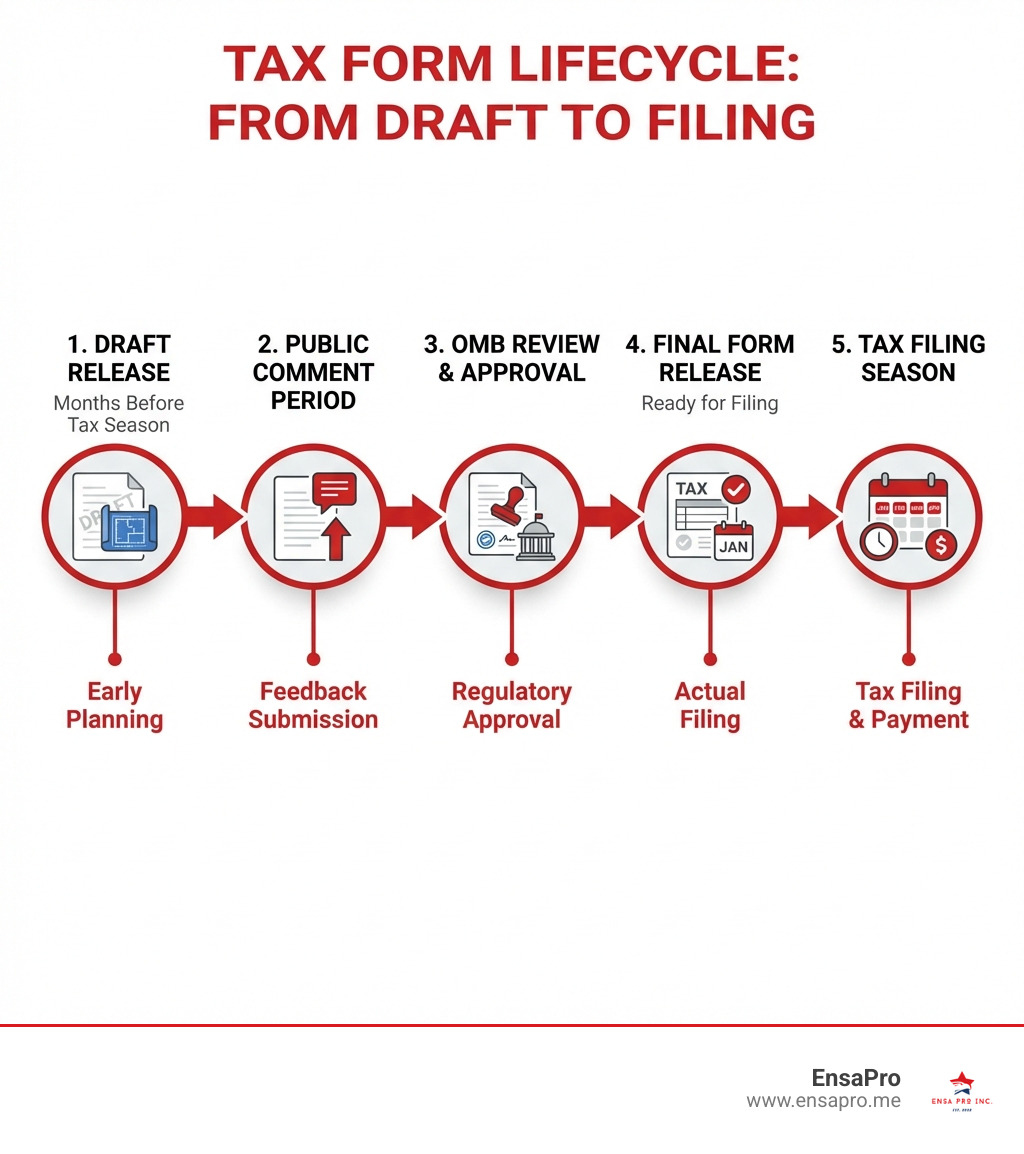

- Timeline: Released months before final forms, which require OMB approval before official use

Filing taxes might not be thrilling, but waiting until April to think about them can cost you money. Draft tax forms let you peek at next year's requirements now, giving you time to make smart financial moves before the year ends.

The IRS releases these early versions so taxpayers can understand what's coming. They note: "This is an early release draft of an IRS tax form... which the IRS is providing for your information." While you can't actually file with a draft, you can use it to estimate your tax bill, identify potential deductions, and plan contributions to retirement accounts or HSAs.

The real value? You can run "what-if" scenarios. Considering a pay raise? Selling investments? A draft form helps you understand the tax impact before you make major financial decisions.

What's in a Draft Tax Form and Where to Find Them

A draft income tax return typically refers to the preliminary versions of key forms like the federal Form 1040 or California's state tax forms. These drafts are invaluable for understanding the tax landscape for the upcoming year before the official season begins.

A draft Form 1040 provides early insights into several critical areas:

- Core Information: This includes your personal details, filing status (e.g., Single, Married Filing Jointly), and information about any dependents.

- Digital Assets Question: A prominent question in recent years asks whether you "received, sold, exchanged, or otherwise disposed of any digital asset," highlighting the IRS's focus on cryptocurrency transactions.

- Income and Adjustments: The form shows how to report all income sources (wages, investments, etc.) and lists "above-the-line" deductions (like IRA contributions) that reduce your Adjusted Gross Income (AGI).

- Deductions and Credits: Drafts reveal the upcoming standard deduction amounts, which are adjusted annually for inflation. This helps determine whether to itemize or take the standard deduction. They also detail tax credits, such as the Child Tax Credit, which reduce your tax bill dollar-for-dollar.

- Tax and Payments: The form guides the calculation of your total tax liability and accounts for payments already made through withholding or estimated taxes, ultimately determining your refund or amount owed.

Understanding these sections is key to a thorough year-end financial review. We analyze your information, review all income sources, and calculate your AGI, which is a foundational number for many tax benefits. We then weigh the benefits of deductions (which lower taxable income) against credits (which directly reduce tax). By spotting new legislation or shifts in eligibility requirements within the draft, we can ensure you benefit from every available tax-saving opportunity.

Understanding Your Draft Income Tax Return

When you look at a draft Form 1040, pay attention to these core sections and how they apply to you:

- Personal information: Verify your name, Social Security number, and address, and confirm the filing status that fits your situation.

- Income sources: Identify where wages, self-employment income, interest, dividends, and capital gains will be reported so you can project full-year income.

- Adjustments to income (AGI): Note the lines for educator expenses, HSA deductions, IRA contributions, and self-employment deductions that reduce AGI.

- Deductions vs. credits: Compare the standard deduction shown in the draft to your potential itemized deductions, and review credit sections such as education credits or the Child Tax Credit.

- New legislation changes: Scan for any newly added lines, questions, or notes that reflect recent tax law changes, as these can affect your planning for the year.

Finding Federal and State Draft Forms

To get the most accurate information, always consult official sources.

For federal forms, the IRS maintains a dedicated page: IRS.gov/DraftForms. Here, you'll find early drafts of Form 1040 and its schedules, clearly marked "DRAFT—NOT FOR FILING." You can also access specific draft PDFs directly, such as the latest available draft Form 1040. These are for informational purposes only and are subject to change.

For our clients in California, the Franchise Tax Board (FTB) provides state-specific drafts on its website at California draft tax forms. Like the IRS, the FTB's drafts help us anticipate state-level changes and plan accordingly.

These drafts are released for public feedback and to help tax professionals prepare. They are never to be filed. The final, approved versions are released closer to the end of the year and are the only ones used for official filing.

How to Use a Draft Income Tax Return for Planning

The power of a draft income tax return lies in its ability to transform tax planning from a reactive scramble into a proactive strategy. We use these early forms to model "what-if" scenarios, helping you see the tax implications of choices like a pay raise or selling investments before they're set in stone. This foresight allows for adjustments to withholding, estimated payments, or year-end tax-loss harvesting.

To create a mock tax return, we follow a systematic approach. We start by gathering your financial documents (W-2s, 1099s) and projecting your income for the current year. Using the draft form, we input your income, apply adjustments to find your estimated Adjusted Gross Income (AGI), and decide between the standard or itemized deductions. After calculating your taxable income and applying any expected credits, we can estimate your final tax liability and determine if you're on track for a refund or owe additional tax. This process gives us a clear picture of your potential tax obligations and reveals areas for optimization.

Estimating and Preparing for Tax Season

One of the biggest benefits of using a draft form is estimating your future tax bill with greater accuracy. We analyze how your income fits into the marginal tax brackets and pay close attention to new deduction limits and credit eligibility rules revealed in the draft. For example, an increased standard deduction might change the best strategy for you. This analysis helps us project whether you'll get a refund or owe money, allowing us to recommend strategies like adjusting withholding or making contributions to tax-advantaged accounts (IRAs, HSAs).

Using a draft form is the ultimate pro-tip for early tax season prep. It helps identify the exact documents you'll need, so you can gather W-2s, 1099s, and receipts throughout the year instead of scrambling at the last minute. This proactive approach ensures you have all the necessary documentation, reduces stress, and prevents you from missing out on valuable deductions. By planning ahead, you can turn tax season into a smooth, manageable process.

Navigating the Uncertainty of Draft Legislation

Proposed tax laws can linger for months or years, creating uncertainty. Acting on a proposed change that is later abandoned can be risky, but waiting could mean missing an opportunity. The key is understanding that new laws can be passed with retroactive effect, applying to a tax year that has already passed. This can lead to unexpected tax bills or refunds.

The benefit of considering draft legislation is proactive planning; the risk is that the final law may differ, requiring you to amend your return. If a tax law changes after you've filed, you'll typically need to file an amended return using Form 1040-X. Generally, you have three years from the date you filed your original return to claim a refund.

Filing Based on Proposed vs. Enacted Law

The IRS is clear: draft income tax return forms are "NOT FOR FILING." You must always file your official return based on the enacted law at the time of filing, using the final forms.

However, draft legislation is a powerful planning tool. If a beneficial change seems likely to pass, you might adjust your financial behavior in anticipation. If the law is enacted retroactively, you can then amend your return to claim the benefit. Conversely, if a proposed change is detrimental, you can plan to mitigate its impact. The IRS expects taxpayers to comply with all enacted laws, so if a retroactive change increases your tax liability, you must amend your return and pay the difference, potentially with interest and penalties.

What to Do When Tax Laws Change After You File

If a law changes after you file, you may need to act. If you relied on a draft proposal that was abandoned and now owe more tax, you should file an amended return (Form 1040-X). The IRS may waive penalties if you act promptly. If a new law benefits you retroactively, you can also file an amended return to claim a refund.

The statute of limitations for the IRS to reassess your return is generally three years. This is also the window you have to file an amended return for a refund. This period can be extended to six years for a substantial omission of income, and there is no limit in cases of fraud.

Navigating these complexities is where professional advice is crucial. Our team in Irvine stays on top of the latest tax legislation and can help you determine if an amended return is necessary, ensuring you remain compliant while optimizing your tax position.

Frequently Asked Questions about Draft Tax Forms

We often get questions from our clients about draft income tax return forms. Here are some of the most common inquiries, along with our expert answers:

Can I file my taxes using a draft form?

No, absolutely not. Draft forms are explicitly marked "DRAFT—NOT FOR FILING." They are preliminary, subject to change, and will be rejected by the IRS and state tax authorities. Their sole purpose is for planning and informational use, not official submission. Always wait for the final, official versions.

What's the difference between a draft form and a final form?

A draft income tax return is a preliminary version released for public review and feedback. It may contain errors, lack final instructions, and is not yet approved for use (federal forms require OMB approval). The final form is the official, approved version that has passed all reviews. It is the definitive legal document used for filing your taxes.

Why should I care about a draft income tax return?

Caring about draft forms is smart financial management. It gives you a sneak peek at the upcoming tax year, allowing you to:

- Plan Early: Start your tax strategy months in advance by identifying potential deductions and credits.

- Make Informed Decisions: Understand the tax impact of financial choices, like deferring income or maximizing retirement contributions.

- Prepare for Changes: Get ahead of new tax laws, such as updated reporting requirements or deduction amounts.

- Organize Documents: Know what paperwork to gather throughout the year to avoid a last-minute scramble.

- Avoid Surprises: Estimate your tax liability to prevent an unexpected bill in April.

In short, engaging with draft forms empowers you to take control of your tax situation.

Conclusion

Understanding and utilizing a draft income tax return is a powerful tool for proactive tax planning, turning potential year-end stress into a strategic advantage. We've seen how these early versions of forms, like the federal Form 1040 and California's state tax forms, offer invaluable insights into upcoming changes in deductions, credits, and reporting requirements.

By reviewing draft forms, we can:

- Estimate your tax liability with greater accuracy, even before the official tax season begins.

- Conduct "what-if" scenarios to understand the tax implications of major financial decisions like a pay raise or investment sales.

- Identify and organize necessary documentation throughout the year, making tax season smoother.

- Prepare for potential legislative changes, knowing when and how to amend returns if laws are enacted retroactively or abandoned.

- Reduce surprises and optimize your financial position.

We believe that proactive tax planning is a cornerstone of financial wellness. It allows you to make informed decisions, maximize your savings, and ensure compliance without the last-minute scramble.

That's where EnsaPro comes in. Located right here in Irvine, California, we specialize in personalized tax preparation services designed to achieve the best possible outcome for you. We offer a unique, no-obligation approach, starting with a free draft of your tax return. This allows you to see exactly where you stand and understand our strategy before committing. We also provide IRS status checks, keeping you informed every step of the way.

Don't wait until April to think about your taxes. Take control of your financial future today.

Get your free tax return draft today