Estate Planning Made Easy: Finding Your Perfect Inheritance Tax Advisor

Why Smart Estate Planning Starts with the Right Advisor

Inheritance tax advisors near me help families protect wealth, reduce tax liability, and ensure assets transfer smoothly to the next generation. Whether you're planning your estate or settling one after a loved one passes, finding a qualified local advisor can save thousands in unnecessary taxes.

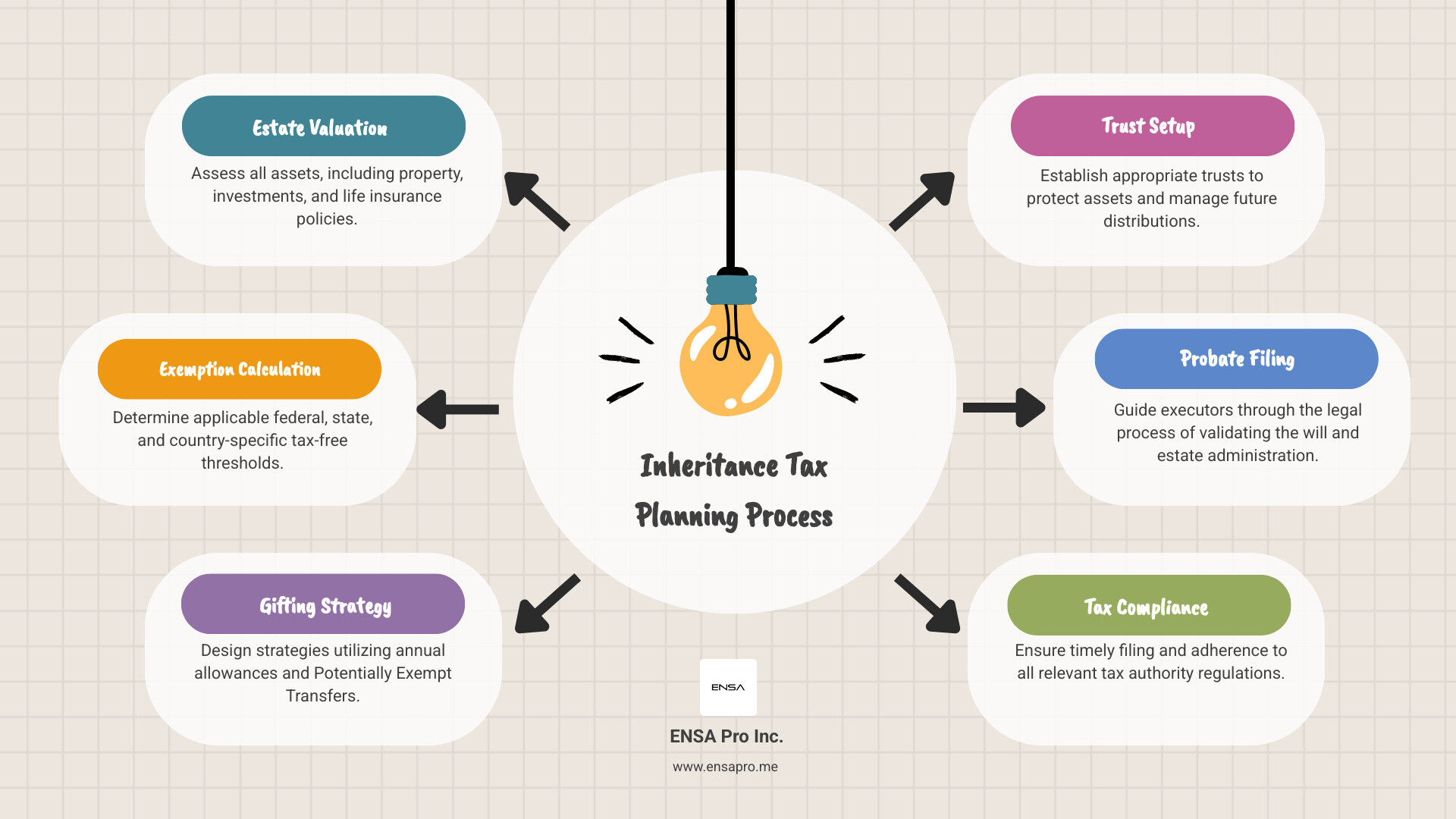

What Inheritance Tax Advisors Do:

- Calculate your tax liability based on current IRS and state thresholds

- Identify deductions and exemptions like the Residence Nil Rate Band or Business Property Relief

- Design gifting strategies to reduce your taxable estate over time

- Set up trusts to protect assets and manage distributions

- Guide executors through probate, tax returns, and compliance deadlines

- Coordinate with attorneys and CPAs to integrate wills and business succession

In the U.S., the federal estate tax exemption is significant, while states like Illinois impose their own estate tax at $4 million. Without proper planning, beneficiaries may be forced to sell property or investments just to cover the tax bill. Inheritance tax rules are complex, vary by location, and change with legislation. Lifetime gifts and trusts can shield assets, but only if structured correctly.

Working with a local specialist matters. A nearby advisor understands your state's laws and can meet face-to-face to craft a personalized strategy. I'm Elias Park, CEO and Founder of Ensa Pro Inc., and over the past three years I've worked with clients to reduce estate tax exposure through proactive planning and trust structuring. In this guide, I'll walk you through how inheritance tax advisors near me can simplify estate planning and minimize your tax burden.

Understanding Inheritance Tax: Thresholds and Liability

When people search for "inheritance tax advisors near me" in California, they are often thinking about the federal estate tax, as California does not levy its own state-level inheritance or estate tax. This is a common point of confusion that a knowledgeable advisor can clarify. While some states have their own thresholds, here in California, we primarily focus on federal estate tax implications for larger estates.

The federal estate tax is a tax on your right to transfer property at death. It applies to the value of assets that exceed a certain tax-free threshold. For those in the UK, Inheritance Tax (IHT) applies to estates above £325,000 at a 40% rate. This highlights how vastly different tax systems can be, making localized advice indispensable.

Our goal at Ensa Pro Inc. is to ensure your estate planning aligns with both your wishes and current tax laws, whether federal or state-specific to California's probate regulations.

Current Tax Thresholds and Rates

The most significant threshold for residents of Irvine and Orange County is the federal estate tax exemption. As of 2020, this exemption stood at $11.58 million per individual. If your total estate value is below this, your heirs generally won't owe federal estate tax. However, this exemption is scheduled to change, which makes proactive planning critical. Charitable giving can also significantly reduce your taxable estate at the federal level. For more detailed information, consider our Inheritance Tax Planning advice.

Who is Liable to Pay?

The responsibility for paying federal estate tax falls on the estate itself, specifically on the executor. Before assets are distributed, the estate must settle its tax obligations with the IRS. If the estate is valued above the federal exemption, the executor will need to file Form 706. Beneficiaries themselves are generally not directly liable for federal estate tax, and since California doesn't have an inheritance tax, beneficiaries in Orange County are not subject to a state-level tax on what they receive. Domicile status and accurate asset valuation are critical components that an experienced advisor can help manage efficiently.

Key Strategies to Minimize Your Tax Burden

Minimizing your federal estate tax burden requires proactive planning. It involves utilizing legal strategies and exemptions to ensure more wealth passes to your loved ones. Our team at Ensa Pro Inc. focuses on personalized strategies that consider your unique financial situation in Orange County. For more information on our comprehensive financial planning, please visit our More info about tax services page.

Potentially Exempt Transfers (PETs) and Gifting

Gifting is a straightforward way to reduce the size of your taxable estate. The IRS allows you to give away a certain amount each year, known as the annual gift tax exclusion, without incurring gift tax. For 2023, this amount is $17,000 per recipient. Beyond the annual exclusion, gifts to your spouse, qualifying charities, or direct payments for tuition and medical expenses are generally excluded from gift tax.

While the US doesn't have a direct equivalent to the UK's "seven-year rule," gifts exceeding the annual exclusion count against your lifetime gift tax exemption. Tracking all gifts and understanding their impact on your unified credit is crucial. Our inheritance tax advisors near me can help you develop a strategic gifting plan that maximizes these exclusions. For a deeper dive, explore our article on Lifetime gifting and tax traps.

The Role of Trusts in Estate Planning

Trusts are powerful tools for federal estate tax minimization and asset protection.

- Revocable Living Trusts: These are excellent for avoiding probate and managing assets during incapacity, but assets are still considered part of the taxable estate for federal purposes.

- Irrevocable Trusts: Once created, these generally cannot be changed. When assets are properly transferred, they are typically removed from the taxable estate, potentially reducing federal estate tax liability.

Common types include Irrevocable Life Insurance Trusts (ILITs), Grantor Retained Annuity Trusts (GRATs), and Charitable Trusts. Our team specializes in designing these complex structures to ensure they comply with IRS regulations and meet your family's long-term goals. For custom solutions, explore our services in Advanced Tax Planning and Asset Protection.

Why You Need Professional Inheritance Tax Advisors Near Me

Navigating the complexities of federal estate tax planning is not a task for the faint of heart. The rules are intricate, and a single misstep can have significant financial consequences. This is why seeking professional inheritance tax advisors near me is essential. We bring a blend of financial planning acumen, tax compliance expertise, and legal insight to the table. For more insights, check out our article on Tax Advisors in My Area.

Navigating Complex Reliefs and Exemptions

The US federal estate tax system offers provisions that can reduce the taxable value of certain assets, such as valuation discounts for closely held businesses or farms. Maximizing the unified credit and leveraging portability for surviving spouses are key areas where our advisors provide value. We also guide executors and trustees through their fiduciary duties, ensuring compliance and minimizing personal liability while claiming all available federal exemptions.

The Benefits of Local Inheritance Tax Advisors Near Me

Choosing local inheritance tax advisors near me in Orange County offers distinct advantages:

- Understanding State-Specific Laws: California has unique probate and property laws that impact estate planning. A local advisor ensures your plan is compliant within our state's framework.

- Familiarity with Local Probate Courts: Understanding the procedures of Orange County's local probate courts can streamline the process and save time.

- Personalized Strategy: Local advisors offer face-to-face consultations, fostering a deeper understanding of your family dynamics and long-term goals.

- Accessibility: Being able to easily meet with your advisor provides peace of mind and ensures timely adjustments to your plan.

We pride ourselves on offering this personalized, localized service. For guidance on selecting the right expert, see our resources on Finding the right Inheritance Tax Planner.

How to Find and Evaluate an Expert Advisor

Finding the right expert to guide you through federal estate tax planning is a critical step in securing your family's legacy. When searching for "inheritance tax advisors near me," you'll encounter CPAs, tax attorneys, and financial advisors. Each brings different skills, and a collaborative approach often yields the best results. We, at Ensa Pro Inc., emphasize a holistic approach to your financial life.

Evaluating Inheritance Tax Advisors Near Me

- Professional Designations: Look for CPAs or attorneys specializing in estate planning and probate law.

- Specialized Experience: Ensure the advisor highlights expertise in federal estate and gift tax planning.

- Client Reviews: Online reviews and referrals provide insights into an advisor's professionalism and effectiveness.

- Initial Consultation: Use this opportunity to discuss your needs and understand their fee structure.

- Local Knowledge: An advisor familiar with California's probate courts can provide more relevant advice.

| Feature | Financial Advisor | Tax Attorney | CPA |

|---|---|---|---|

| Primary Focus | Wealth management | Legal aspects | Tax compliance |

| Key Role | Tax efficiency | Drafts wills/trusts | Prepares tax returns |

| Best For | Holistic strategy | Legal structures | IRS compliance |

For comprehensive advice, our Inheritance Tax Advisers are equipped to provide the expertise you need.

Integrating Wills and Business Succession

Your will is the cornerstone of your estate plan, specifying how assets are distributed and who will manage your estate. A well-drafted will avoids intestacy and can streamline the probate process. For business owners in Orange County, integrating business succession planning is paramount. This involves Buy-Sell Agreements, accurate Share Valuation, and Leadership Transition planning. Our inheritance tax advisors near me can help you craft a succession plan that minimizes federal estate tax implications and ensures business continuity. We offer specialized guidance for Estate planning for farmland and business owners.

Frequently Asked Questions about Inheritance Tax

What is the difference between a will and inheritance tax planning?

A will is a legal document that dictates how your assets will be distributed and who will manage your estate. Inheritance tax planning is the strategic process of organizing your affairs during your lifetime to minimize the federal estate tax burden. While a will is essential, it doesn't reduce taxes on its own; tax planning strategies like gifting and trusts work alongside it.

How does the seven-year rule affect lifetime gifts?

The "seven-year rule" is a UK concept. In the US federal system, gifts exceeding the annual exclusion ($17,000 in 2023) count against your lifetime gift tax exemption. This reduces the amount of your estate that can pass federal estate tax-free at death. There isn't a specific "seven-year rule" that pulls gifts back into your estate in the same way, but proper documentation is still essential.

Can I avoid inheritance tax by putting my house in a trust?

It depends on the trust type. A Revocable Living Trust helps avoid probate in California, but the house remains part of your taxable estate for federal purposes. An Irrevocable Trust can remove the house from your taxable estate, potentially reducing federal tax, but you lose control over the property. Consult with experienced inheritance tax advisors near me to determine the right strategy for your home.

Conclusion

Navigating federal estate tax planning and ensuring your legacy is protected can feel overwhelming, but it doesn't have to be. By working with dedicated inheritance tax advisors near me in Orange County, you gain a partner committed to securing the financial future of your loved ones. Our expertise helps you understand federal laws, leverage exemptions, and implement strategies like gifting and trusts to minimize tax liabilities effectively.

At Ensa Pro Inc., we offer personalized tax preparation services, including a free draft and IRS status checks, to ensure you achieve the best possible outcome. Don't leave your family's future to chance. Contact Us today to schedule a consultation and start building a robust estate plan together. Start your tax planning today and experience the difference of expert guidance.