Don't Pay for Taxes: Find Free Tax Prep Near You

What is Free Tax Prep in Orange County?

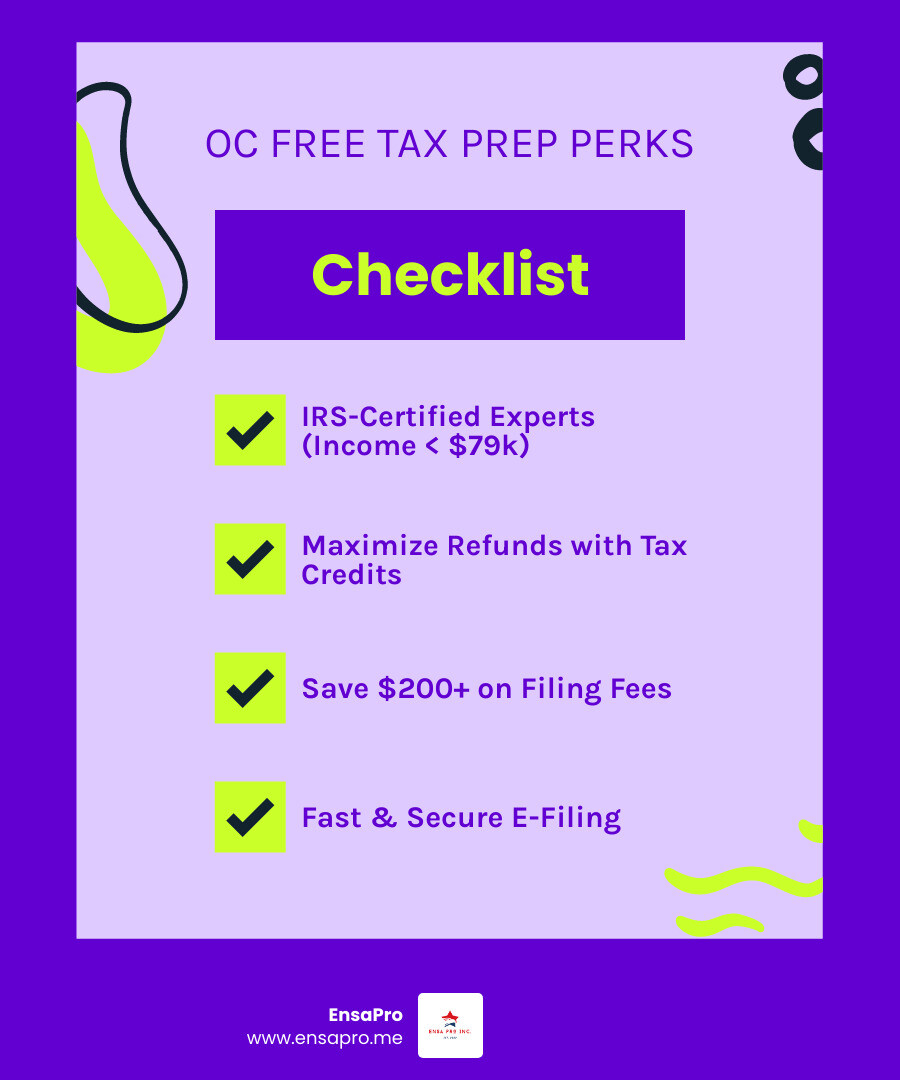

Free tax preparation in Orange County is a community initiative that helps thousands of residents file their taxes for free each year. If you're looking for free tax preparation services near you, here's what you need to know:

Quick Answer: Free Tax Prep Services in Orange County

| What | Details |

|---|---|

| Who Qualifies | Individuals and families who earned below a certain income threshold in the last tax year |

| Where to File | Numerous in-person locations across Orange County, or online through free tax software |

| Cost | Completely free (average savings: $200+ in prep fees) |

| Languages | English, Spanish, Korean, Vietnamese, and more |

| Appointment | Often required; check with local program providers for details |

Tax season can feel overwhelming, especially when you're worried about missing deductions or paying high fees. But here's the good news: you don't have to steer it alone or pay hundreds of dollars for help.

These free tax prep services are often part of broader financial security initiatives run by local non-profits, serving the community for many years. The programs connect you with IRS-Certified volunteer tax preparers who help you file both federal and California state returns at no cost.

Last year alone, thousands of community members received free tax preparation services, returning millions in tax refunds to local families. Many clients report significant savings on filing fees and express gratitude for the professional and caring service they receive.

The program goes beyond just filing your taxes. It helps you claim valuable tax credits like the California Earned Income Tax Credit (CalEITC) and federal EITC—credits that many people miss out on simply because they don't know they exist. You may qualify for hundreds or even thousands of dollars in cash back.

If you want to explore general details on tax credits and filing, you can also review official guidance from the Internal Revenue Service. Whether you prefer working with a tax expert in person or filing online from home, free tax programs offer flexible options to fit your needs.

Your Complete Guide to Free Tax Prep: Eligibility and Benefits

Navigating tax season can often feel like trying to solve a complex puzzle, especially when you're trying to make every dollar count. For hardworking individuals and families in Orange County, free tax preparation services are more than just a service; they're a lifeline that ensures financial stability and fuels economic growth right in our local community. We're here to guide you through everything you need to know about who qualifies, what you can save, and how this incredible resource makes a real difference.

The core mission of these programs is to support thousands of Orange County residents by providing free tax preparation services. This ensures that you maximize your refunds and access all the valuable tax credits you're entitled to. By putting more money back into the hands of families, we collectively strengthen financial stability and stimulate local economies. It's a win-win for everyone!

Many people don't realize just how much they can save by using free tax preparation services. For instance, it's not uncommon for individuals to receive substantial refunds and save hundreds in filing fees. These numbers speak volumes about the tangible financial benefits.

What Are the Eligibility Rules for Free Tax Prep?

One of the most common questions we hear is, "Am I eligible?" The good news is that free tax preparation programs are designed to serve a wide range of low-to-moderate income individuals and families. The primary eligibility requirement for using these services revolves around your income.

For the most recent tax year, if your household income was below a certain threshold (which can change annually), you are likely eligible for free tax preparation assistance from IRS-Certified experts. This threshold is set to ensure that the program helps those who can benefit most from saving on preparation fees and maximizing their refunds. These services are generally for basic tax returns. While the IRS-Certified preparers are highly skilled, extremely complex tax situations (such as those involving extensive self-employment with numerous deductions, rental properties, or significant investment portfolios) might be outside the scope of what can be handled by volunteer assistance programs.

To get a definitive answer on your eligibility and ensure your specific tax situation can be covered, we highly recommend contacting local community service organizations that offer these programs. We want to make sure you get the help you need!

The Financial Benefits of Filing for Free

Let's talk about the best part: the money you save and the money you get back! The financial benefits of using free tax preparation services are truly substantial.

Firstly, the most obvious benefit is saving on filing fees. The cost of professional tax preparation can range anywhere from $200 to $600 or even more, depending on the complexity of your return. By using these free services, you eliminate this expense entirely. Many clients save hundreds of dollars on filing fees that would otherwise be spent on paid preparers. That's money that stays in your pocket, ready for bills, savings, or a much-deserved treat.

Beyond avoiding fees, the program excels at maximizing your refund. The IRS-Certified tax preparers are trained to identify every deduction and tax credit you qualify for. This is crucial because many valuable credits, like the California Earned Income Tax Credit (CalEITC) and the federal EITC, are commonly unclaimed simply because people aren't aware of them or how to apply. They help you get every dollar you're entitled to, potentially turning a small refund into a significant one. One client, for example, received a $1,500 refund thanks to expert handling, while another even qualified for a senior discount that further boosted their savings.

To make things even better, these programs typically offer direct deposit and e-filing at no cost. This means you can get your refund faster and more securely. No waiting for a paper check, no worries about it getting lost in the mail—just quick access to your hard-earned money. The convenience and financial peace of mind are invaluable.

How to Access Free Tax Filing Services in Orange County

Getting your taxes done for free in Orange County is designed to be as convenient and accessible as possible. Whether you prefer face-to-face assistance or the comfort of your own home, free tax preparation programs offer multiple avenues to ensure you can file your federal and California state returns without a hitch. Services are even available in multiple languages, including English, Spanish, Korean, and Vietnamese, thanks to trained and friendly volunteers.

Find an In-Person Location Near You

For those who appreciate direct interaction and personalized guidance, finding an in-person location is a great option. These programs operate through a network of locations across Orange County, making it easy to find a site that's convenient for you. At these sites, you'll work directly with IRS-Certified volunteer tax preparers. These dedicated individuals are trained to provide expert help, ensuring your return is accurate and complete.

To ensure you receive the best service without long waits, appointments are typically required at these volunteer-run tax assistance locations. Scheduling can often be done by phone. It's always a good idea to call ahead and confirm operating dates and hours, as they can vary by site.

To explore available sites and find the one closest to you, you can search online for "free tax prep near me" or contact local community centers, making your tax preparation journey straightforward and stress-free.

File Online or Virtually from Home

If you're comfortable with technology or prefer the flexibility of filing from your own space, many free tax programs offer excellent online and virtual options. These services provide the same expert assistance but with the added convenience of remote access.

One popular option is using free online tax software. If you're comfortable with a computer, you can use guided software from the comfort of your home. It's really that simple: you answer a series of questions, and your tax forms are automatically generated for you. This is a fantastic solution for those who want to maintain control over their filing process with step-by-step support.

For a more guided virtual experience, some programs offer virtual tax prep services. Through a secure web portal, you can upload your tax information, speak to an IRS-Certified volunteer over the phone, and get your taxes done virtually—all for free! This process ensures your identity is verified, your finances are accurately documented, and you have a chance to review everything with an expert before e-filing. This hybrid approach combines the convenience of online filing with the reassurance of professional guidance.

Whether you choose in-person or online, these programs are committed to making your tax filing experience as easy and beneficial as possible.

Preparing for Your Appointment: Documents and Key Tax Credits

Getting ready for your free tax preparation appointment doesn't have to be daunting. A little preparation goes a long way in ensuring a smooth and efficient process. Having all your necessary documents organized will allow the IRS-Certified volunteers to accurately prepare your federal and California state returns and ensure you claim every credit you deserve. This step is crucial for maximizing your refund and opening up valuable tax credits.

What Documents Do I Need for a Free Tax Prep Appointment?

To make your appointment as productive as possible, please gather the following essential documents:

- Picture Identification: Valid photo ID for yourself and your spouse (if filing jointly). For joint returns, both spouses typically need to be present to sign required forms.

- Social Security Cards or ITIN Letters: For all individuals listed on your tax return (yourself, spouse, and dependents). This is non-negotiable for accurate filing.

- Income Documents:

- W-2s: From all employers.

- 1099s: (e.g., 1099-NEC for non-employee compensation, 1099-INT for interest, 1099-DIV for dividends, 1099-R for retirement distributions, 1099-G for unemployment income).

- Other Tax-Related Documents: Any other forms showing income or deductions for the tax year.

- Form 1095-A, B, or C: Your health insurance coverage statement. This is important for verifying healthcare coverage.

- Form 1098-E and 1098-T: If you or your dependents had educational expenses or student loan interest.

- Childcare Provider Information: If you paid for childcare, bring the provider's name, address, phone number, and Tax ID Number (EIN or SSN). This is necessary for claiming childcare credits.

- Bank Account Information: For direct deposit of your refund, bring your bank account number and routing number. Direct deposit is the fastest and safest way to receive your refund.

- Copy of Previous Year's Income Tax Return: This helps preparers understand your tax history and can be useful for certain deductions or credits.

Having these documents ready will allow volunteers to quickly and accurately prepare your return, ensuring you don't miss out on any potential savings.

Opening up Valuable Tax Credits like CalEITC

One of the most significant advantages of using these free services is the expertise in helping you access valuable tax credits. These aren't just deductions; they are often "cash back" credits that can dramatically increase your refund, sometimes by hundreds or even thousands of dollars! Many people miss these simply because they don't know they exist or how to claim them.

Key credits these programs help you explore include:

- California Earned Income Tax Credit (CalEITC): This is a refundable state tax credit for low-to-moderate income working individuals and families. If you worked in California, are 18 or older, have a valid SSN for work, and lived in California for at least half the year, you may qualify for this impactful credit. In recent years, households earning below a certain threshold may have qualified for hundreds or thousands of dollars in cash back through the expanded CalEITC. Young children in lower-income families benefiting from CalEITC are even more likely to go to college!

- Federal Earned Income Tax Credit (EITC): Similar to CalEITC, the federal EITC is a refundable tax credit for low-to-moderate income working individuals and families. If your income falls within the program's limits for the last tax year, IRS-certified tax experts can help you claim this credit.

- Child Tax Credit: This federal credit provides financial relief to families with qualifying children.

- Education Credits: Various credits exist for higher education expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

These credits are designed to support families and individuals, and the IRS-Certified preparers are skilled at identifying every one you might be eligible for. The goal is not just to file your taxes, but to ensure you get every dollar you deserve, helping you boost your refund and improve your financial well-being. You can learn more about how these credits can benefit you by researching them on the official IRS and California Franchise Tax Board websites.

The People Behind Free Tax Prep: Community Partners and Volunteers

The success of free tax preparation programs in Orange County is a testament to the power of community collaboration and the dedication of incredible volunteers. This isn't just a service; it's a movement powered by local organizations working together to build a stronger, more financially secure Orange County. These programs have been a community-trusted resource for many years, with some operating since 2005, and that trust is built on the foundation of shared commitment.

The Role of Community Partners

At their heart, these free tax programs are often empowered by local non-profits and are a key part of broader financial security initiatives. This partnership is vital because it aligns tax preparation services with broader community goals of financial empowerment. By providing free, expert tax assistance, they help families transition from merely surviving to truly thriving.

Community partners play a crucial role in making these programs accessible and impactful. They provide locations, resources, and help spread the word, ensuring that thousands of hardworking Orange County residents know where to turn for help. When more families receive their maximum tax refunds and access valuable credits, it doesn't just help individuals; it injects money directly into local economies. This stimulates growth, supports local businesses, and strengthens the overall financial health of our community. It's a powerful example of how collective action can lead to significant positive change.

How to Become a Volunteer Tax Preparer

Incredible volunteers are the backbone of these free tax preparation programs. Without their dedication and expertise, this resource simply wouldn't be possible. Becoming a volunteer tax preparer is a unique opportunity to make a tangible, positive impact on your community while gaining valuable skills.

As a volunteer, you'll receive comprehensive IRS certification training. This training equips you with the knowledge and confidence to accurately prepare federal and California state income tax returns for individuals and families. It's not just about numbers; you'll also gain hands-on experience in customer service, learning how to compassionately assist diverse community members with their financial needs.

Imagine the satisfaction of helping someone save hundreds of dollars in filing fees or find a tax credit that provides much-needed cash back. You'll be assisting thousands of local residents in becoming more financially stable and self-sufficient. It's a rewarding experience that offers a unique blend of technical tax knowledge and direct community engagement. If you're looking for a way to give back, grow your skills, and truly make a difference in Orange County, we encourage you to explore volunteer opportunities with local tax assistance programs. Join a team and help empower our neighbors!

Frequently Asked Questions about Free Tax Services

We understand you might have more questions about free tax preparation services. Here, we've compiled answers to some of the most common inquiries to help you better understand the programs and how to access their benefits.

Who can benefit from free tax prep?

Free tax preparation services are specifically designed to support low-to-moderate income individuals and families in Orange County. Generally, if your household earned below a certain income threshold in the previous tax year, you are likely eligible for our free tax preparation services. This income threshold ensures that the program reaches those who can most benefit from saving on preparation fees and maximizing their refunds. These services are designed for basic tax returns, helping you steer the complexities without the cost.

Are the volunteer tax preparers qualified?

Absolutely! The qualification of tax preparers at these sites is taken very seriously. All volunteers are IRS-Certified, which means they undergo rigorous training and pass IRS-mandated exams to ensure they have the expertise to accurately prepare basic tax returns. These IRS-Certified preparers are trained to understand current tax laws, identify all eligible deductions, and help you claim commonly unclaimed tax credits like the CalEITC and federal EITC. You can rest assured that you're receiving expert help from trained and friendly individuals who are committed to getting you the best possible outcome.

How can I get updates or ask questions?

Staying informed about tax deadlines, program updates, and any changes to eligibility or services is easy. You can find information about local programs, locations, and appointment scheduling by searching online for "free tax help in Orange County" or by contacting local community centers and non-profit organizations. They can provide the most current details and answer specific questions you may have.

We're committed to providing clear communication and accessible support throughout the tax season, ensuring you have all the resources you need at your fingertips.

Conclusion: Take Control of Your Taxes This Year

Filing taxes doesn't have to be expensive or stressful. Thanks to free tax preparation programs, thousands of Orange County residents can steer tax season with confidence, knowing they have expert, IRS-Certified help at no cost. By utilizing these free community resources, you can save hundreds on preparation fees and ensure you receive the maximum refund and all the valuable tax credits you're entitled to. This not only benefits your personal finances but also contributes to the economic vitality of our entire community.

We've explored how these free programs empower low-to-moderate income individuals and families, detailed the eligibility requirements, highlighted the significant financial benefits, and guided you on how to access both in-person and online services. We've also provided a comprehensive checklist of documents needed and shed light on critical tax credits like CalEITC that can put more cash back in your pocket.

Whether you choose to file with an expert in person, use a secure online portal, or become a volunteer yourself, you're part of a larger initiative dedicated to financial security for all.

For those who may not qualify for free services due to higher income thresholds, or if you have more complex tax situations that require specialized attention, exploring personalized tax services can provide immense peace of mind and expert guidance. At EnsaPro, we offer a thorough, personalized approach, including a free draft and IRS status checks, to ensure the best possible outcome for your unique financial situation. We believe everyone deserves to feel confident about their taxes. Get professional help with your Irvine tax preparation today.